Capital cities generally get most of the attention when it comes to retail real estate development. Not in Bolivia. There, it was Santa Cruz de la Sierra that received the country’s first mall — and various other projects since — not La Paz, the capital. That pioneering retail real estate property was Ventura Mall, which opened in 2014 with 538,000 square feet of gross leasable area and 176 shops. The mall welcomes some 5.5 million visitors annually, posts yearly sales in excess of $100 million and, with a vacancy rate of only 2 percent, boasts a long waiting list of aspiring tenants. The demand that all this represents has fostered new retail projects, including a sister Ventura mall elsewhere in the city.

“We are going through a development process as a country, and that includes the formalization of our retail market as more global brands arrive,” said Sergio Loma, Ventura Mall’s general manager. “Santa Cruz is the first stop for these firms in Bolivia.”

Among the retailers that have come to the city through Ventura Mall over the past three years are Adidas, Forever 21, Mango, Nike, Swarovski, Tous and Under Armour. And this year P.F. Chang’s China Bistro opened its first Bolivia restaurant, at Ventura Mall.

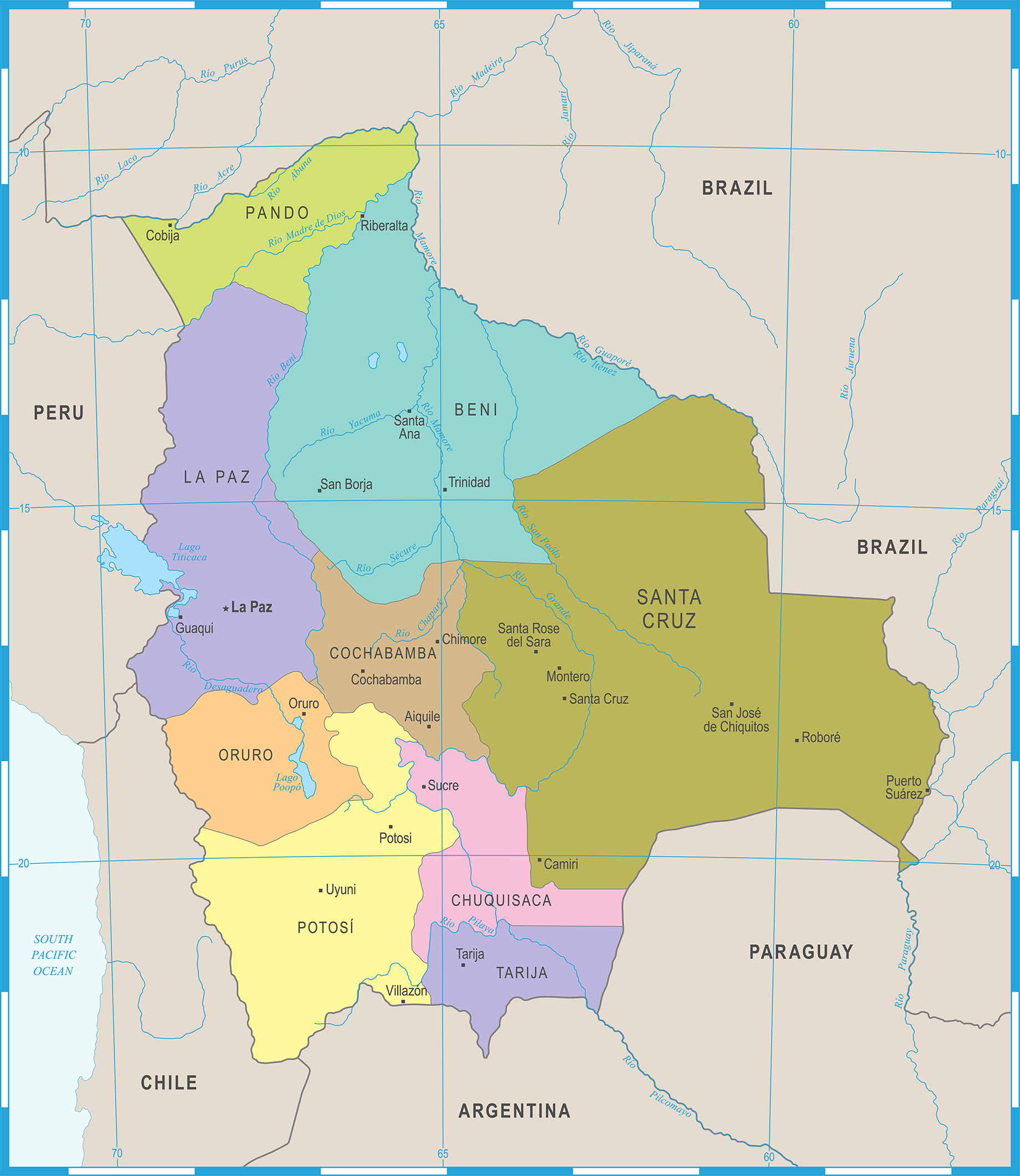

A glance at the demographics of Santa Cruz — capital city of the Santa Cruz department — is likely to make its appeal to retailers obvious. The department’s population is slightly more than 3 million, a fair proportion of Bolivia’s total 10.9 million, according to the Instituto Nacional de Estadística. The Santa Cruz population is projected to grow to nearly 4.1 million by 2030, and thanks to the vibrancy and growth of the manufacturing, mining and agricultural sectors, the unemployment rate has stayed at less than 5 percent over the past decade.

The city of Santa Cruz alone has a population of nearly 2 million, representing the country’s biggest market, according to Gary Antonio Rodríguez Álvarez, general manager of the Santa Cruz–based Instituto Boliviano de Comercio Exterior, a nonprofit dedicated to promoting Bolivia’s exports and economy. “Santa Cruz’s GDP always grows above the national rate, reaching Asia-like rates in recent years,” said Rodríguez Álvarez. “The economic improvement and social mobility of the population are behind the retail boom.”

A steady migration of people from interior regions along with foreign immigrants over the past two decades has created a cosmopolitan city hungry for more shopping options, Rodríguez Àlvarez says. This prompted the Bolivian investors behind Ventura Mall to embark on Ventura Sur, in the southern part of the city. This mall, scheduled to open in June 2020, is to encompass at least 60,000 square meters of gross leasable area. Ventura Sur will lease its space, just like Ventura Mall — and unlike many other malls in this market, which sell their space outright. Ventura Sur is to be part of a mixed-use development that will, in a second phase, also include office and residential buildings.

“We want to build four or five more malls in Santa Cruz, because we believe there is room for more,” said Loma. “Local consumers are increasingly adapting to this retail model, which has also become the new urban plaza in Latin America.”

Ventura Mall opened in 2014 with 50,000 meters of gross leasable area and 176 shops

Indeed, there are other Bolivian developers paying attention to this market, so several retail centers are now under way in Santa Cruz. Last December two levels of the four-story Ciudad Indana opened in the city’s commercial district. Its tenant mix includes a nine-screen multiplex, a food court, a supermarket and a 3,000-capacity amphitheater. Ciudad Indana, a property of Grupo Empresarial Vargas Lobo, is leasing and selling space exclusively to fashion, beauty and technology tenants. The $40 million mall is set to be operating at full capacity by the end of this year, according to Ciudad Indana retail manager Karla Terrazas.

“The group decided to build the mall because [Shopping] Neval shoppers were asking for a bigger mall,” said Terrazas, referring to Shopping Neval, a small retail center owned by the same group and which focuses on technology tenants. “Local consumers are looking for more shopping options like malls because of such conveniences as free parking and clean, safe and air-conditioned facilities.” Shopping centers are also seeing demand by retailers rise as the government cracks down on open retail markets in its battle against the black economy, Terrazas points out.

Also under way is the $20 million El Gigante Ciudad Comercio, which is now going up on the city’s east side and markets itself as a retail and office city that will eventually house some 1,620 tenants among 12 modules. In the city’s La Ramada zone, meanwhile, Grigotá Center is scheduled for a September opening. Its developer, Limcast, says that center will house 32 shops and a seven-story parking facility. The retail space is being sold to retailers.

Retailers, meanwhile, keep coming. Cosmet, the Bolivian firm that has teamed up with MAC Cosmetics to open stores here, had no need to think twice when deciding where to establish its first store. “Santa Cruz is Bolivia’s main commercial city and most developed retail market, offering the right conditions for a MAC freestanding store,” said Jasmina Stanojevich, Cosmet’s vice president of marketing. She points to how the opening of a “formal mall” with international operating standards like Ventura Mall has contributed to the evolution of a market that had long consisted essentially of street sales. The 60-square-meter MAC store at Ventura Mall opened in February.

By María Bird Picó

Contributor, Shopping Centers Today