In the first quarter of this year, Broadstone Net Lease, a Rochester, N.Y.–based private REIT, completed one of its biggest retail acquisitions ever, buying up nine stores from Michigan furniture chain Art Van Furniture and then leasing them back down. “We teamed up with a private equity fund manager that acquired the retail operation and executed a simultaneous sale-leaseback, acquiring a portion of the real estate occupied by the operating company,” said Sean Cutt, Broadstone’s president and COO. “Art Van had an appropriate risk-adjusted return, and the cap rate matched what we felt the risk was in the retail sector.”

Historically, the retail portion of the Broadstone portfolio has been heavily concentrated in the restaurant sector, so this latest deal was a good diversification, Cutt notes. “Art Van is one of the top furniture operators in the Midwest, with a very loyal customer base,” he said. “We felt like the underlying fundamentals of the company and the real estate were a good match for us.”

Such deals are helping drive steady volume in the net-lease sector. Other than a slowdown during election season, the net-lease market remained as strong for last year as it had been for the three previous years, and it has continued that way through the first quarter of this year. “The first part of 2016 was stronger than the second part,” said Andrew Bogardus, San Francisco–based executive director of the Cushman & Wakefield capital markets and net-lease group. “Nevertheless, 2016 ended up being a good year. It seems like there’s a lot of action now, because 1031 buyers need to get their money out, as do the institutional investors and REITs, all of which have allocations to meet.”

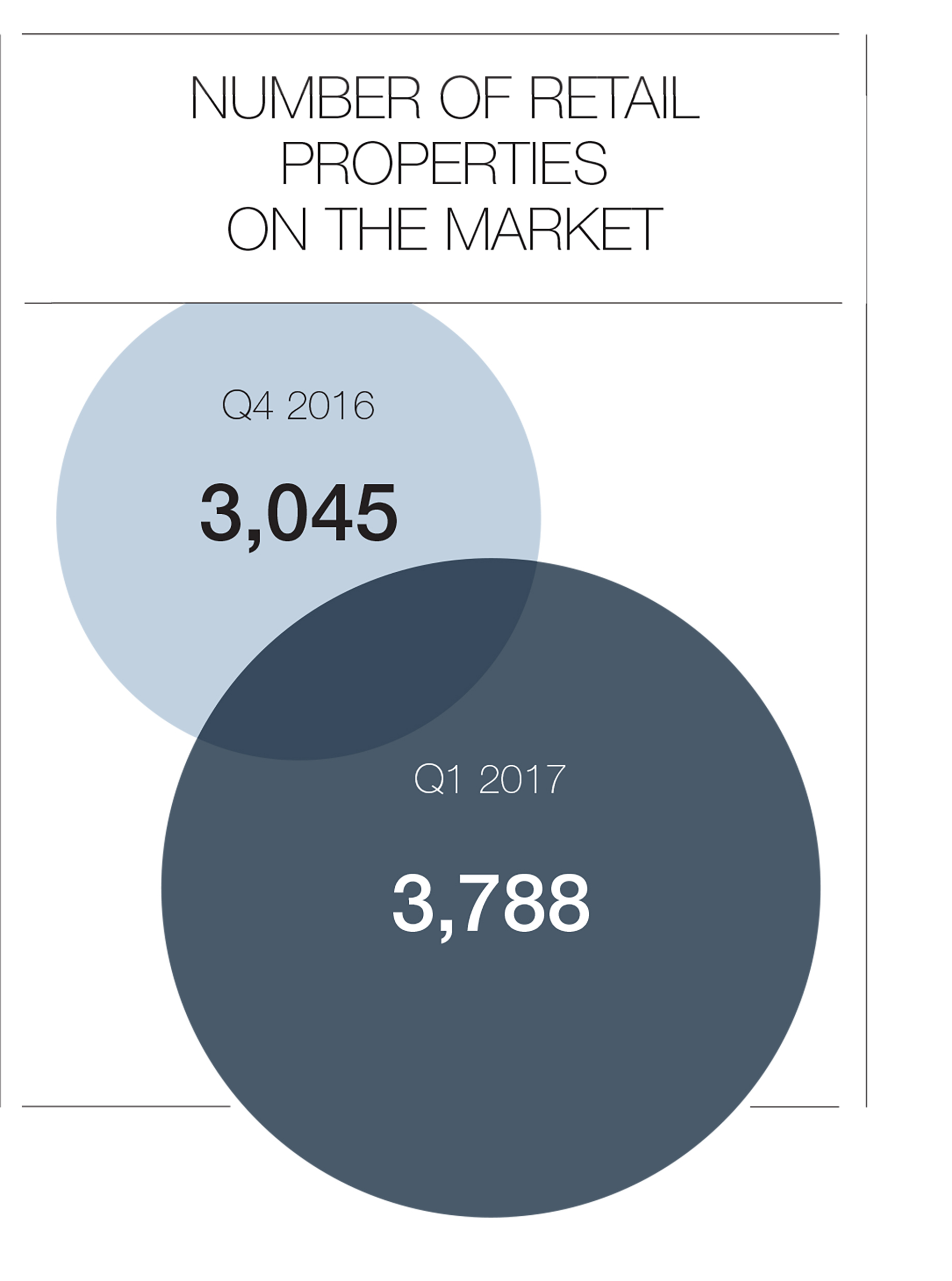

In the first quarter, the supply of retail net-lease properties on the market increased by 24 percent to 3,788. “The overall sentiment is that we are in the late stages of this real estate cycle,” writes John Feeney, vice president at Boulder, Colo.–based brokerage firm The Boulder Group, in his quarterly report on the sector. “Accordingly, property owners are selling assets in the current market to take advantage of the historically low cap-rate environment.”

“We anticipate seeing more sale-leasebacks as companies look to lock into long-term lease rates”

There are other, overarching reasons for the steady volume of net-lease deals. “The global search for yield continues to persist, and there are a lot of capital flows into net lease for that reason,” observed Gino Sabatini, a managing director who heads investments for New York City–based W.P. Carey. Then, too, expectations are that interest rates will continue to rise. “We anticipate seeing more sale-leasebacks as companies look to lock into long-term lease rates, given that rising interest rates typically have an impact on cap rates,” Sabatini said. “You’ll see companies look to lock in these long-term rental rates on leases with terms ranging from 15 to 25 years.”

The net-lease market is fragmented among many ownership entities, but the market could be divided into two basic camps: institutional investors, including REITs, on the one hand, and smaller private investors, mostly 1031 buyers (investors who sell real estate and then acquire like-kind property to defer capital gains or losses), on the other.

The 1031 business actually dominates the net-lease space, though by total dollar volume, some of the publicly traded REITs are a towering presence — National Retail Properties, of Orlando, Fla.; Realty Income Corp., of San Diego; and VEREIT, of Phoenix, among them. “Two or three of the big REITs are doing most of the sales, based on volume, because they are doing bigger deals,” said Bogardus.

Triple threat The supply of retail net-lease properties on the market in the first quarter increased by 24.4 percent between the fourth quarter of 2016 and the first quarter of 2017, reports The Boulder Group. By comparison, the supply of office properties grew by 2.8 percent during the same period

With its $2.1 billion market capitalization, Broadstone would rank about midtier among publicly traded net-lease REITs if it were to go public. “Our fund has evolved over the years,” said Cutt. “Ten years ago we heavily competed with the 1031 market, but as the REIT has grown, we have been able to increase our deal size and acquire portfolios of assets like restaurants and retail buildings.”

Investors are seemingly buying just about anything. “I don’t think we have seen any slowdown in deals,” said Bogardus. “There is good inventory and a good amount of buyers. Recently, we came out with a redevelopment project with short-term leases on a McDonald’s and a 24 Hour Fitness. We went to the market at a 6 cap rate, because of the likelihood 24 Hour Fitness might vacate. Even so, with a $6 million asking price and a 6 cap, we received 15 offers.”

Private investors prefer long-term leases to credit tenants, explaining the compression of cap rates in the first quarter for recently built properties leased to the likes of Advance Auto Parts and CVS, says The Boulder Group’s Feeney. During the first quarter cap rates for such properties compressed by 15 and 25 points, respectively, despite the overall market, he says.

The most expensive properties will be those leased to 7-Eleven, Advance Auto Parts, AutoZone, Bank of America and Chase Bank, according to The Boulder Group. The firm says cap rates on properties leased to these tenants will stay in the lower-than-five-percent range.

“We have seen cap-rate compression in the net-lease space for several years”

According to The Boulder Group, the average national asking cap rates for retail net-lease properties will remain at 6.19 percent in the first quarter. By comparison, the office and industrial sectors are expected to see increases of 4 and 10 basis points quarter on quarter, respectively.

A couple of things could alter the upward sweep of net-lease deal volume in the months ahead. The most apparent of these is an interest rate rise, which will put pressure on cap rates as well. “We have seen cap-rate compression in the net-lease space for several years,” said Cutt. “There is always a lag in the market, but cap rates historically move with interest rates. Either by the end of the first quarter or early in the second quarter, we anticipate a rise in cap rates.” Bogardus expects a slowdown in net-lease deals as cap rates rise.

The other issue is uncertainty over tax reform, which is causing the captains of real estate to fret more than usual. “The U.S. net-lease market remains competitive, and capital flow is strong — although political and policy uncertainty is also beginning to create a more cautious tone,” said Sabatini.

As Cutt put it: “The whole real estate sector needs to be cautious about what the new administration’s policies will be regarding tax reform.”

By Steve Bergsman

Contributor, Shopping Centers Today