Where Did Most New Retail Space Deliver in Q1?

High construction costs kept new retail development in the U.S. low in the first quarter. Completions fell 32% from the previous quarter to 5.8 million square feet, according to CBRE. Rolling 12-month retail completions remained under 30 million square feet for the second consecutive quarter. Six of the 10 markets where the most new retail space was completed during the quarter were in Texas and Florida. The markets are popular for new development because of high population growth, relatively low construction costs and the potential for high rents, according to CBRE.

The 10 Hottest Markets for Retail Development

| Q1 Completions | |

| Houston | 597,000 SF |

| Jacksonville, Florida | 386,000 SF |

| Dallas | 331,000 SF |

| Detroit | 327,000 SF |

| Miami | 324,000 SF |

| Austin, Texas | 322,000 SF |

| Portland, Oregon | 317,000 SF |

| San Antonio | 307,000 SF |

| Sacramento, California | 259,000 SF |

| Riverside, California | 236,000 SF |

Source: CBRE

Grocer H-E-B is the kind of retailer driving new development. During the first quarter, the Texas-based supermarket chain opened three stores across its home state: a 117,000-square-foot store in Katy and a 110,000-square-foot unit in Humble, both in the Houston area, and a 110,000-square-foot store in Fair Oaks Ranch, near San Antonio.

H-E-B’s new Katy, Texas, store

And the company’s expansion plans aren’t slowing. During the first quarter, it also started construction on four properties in the Dallas area: an H-E-B in Prosper, an H-E-B in Melissa, a Joe V’s Smart Shop by H-E-B in southern Dallas on Wheatland Road and one in Katy. Joe V’s is H-E-B’s budget-friendly, small-format concept.

Tight Vacancy? Another Way for Retailers to Expand Is to Buy Their Competitors

It’s hard to find space out there. One way for retailers to get more of it: Buy other retailers, including their stores. JD Sports has offered $1.1 billion to acquire Hibbett, a chain with 1,169 stores. The deal instantly would give the U.K.’s JD Sports a coast-to-coast presence in the U.S., according to Ophelia Makis, JLL senior analyst of retail and hotel capital markets. An April announcement from made-to-measure menswear retailer Knot Standard indicated that apparel brand Billy Reid will add eight stores in major cities by merging with Knot Standard’s direct-to-consumer business. The Knot Standard stores will be rebranded, giving Billy Reid 19 locations nationwide. And in February, Shoe Carnival bolstered its brick-and-mortar presence by acquiring Rogan’s Shoes for $45 million. This deal brings Shoe Carnival’s store count to 429, keeping the brand on pace to reach its stated goal of operating 500 stores by 2028.

More Than One-Third of Bed Bath & Beyond Stores Already Are Backfilled

Bed Bath & Beyond’s former stores rapidly are filling with new tenants. Less than a year after the chain closed 721 stores, 268 have been leased by new tenants, according to a report from Retail Specialists executive vice president Bill Read.

Apparel chains are the most active tenants moving into former Bed Bath & Beyond real estate, the report said. Burlington alone has 73 of the former Bed Bath & Beyond locations. Clothing stores opened in 103 former Bed Bath & Beyond stores. Nordstrom Rack backfilled 11, Sierra filled six and Ross Dress for Less filled five. Among the diverse users taking over the stores: Aldi, an auto dealership, Floor & Decor, H Mart, Hobby Lobby, Lidl, Macy’s, Planet Fitness, pickleball venues, Sprouts Farmers Market and Total Wine & More.

Sam Ash Will Close Its 42 Stores as Guitar Center Expands

U.S. musical instrument and equipment retailer Sam Ash filed for Chapter 11 bankruptcy protection, saying it intends to close all its 42 stores. The company owes about $20 million in unpaid debts to landlords and vendors, according to court filings. Meanwhile, Guitar Center opened its first new store of the year in April. The 17,995-square-foot unit at Westland Promenade in Hialeah is the retailer’s 22nd Florida location. Guitar Center, which now has more than 300 stores, had filed for its own Chapter 11 restructuring in 2020 in order to cut $800 million in debt.

Von Maur Will Spend $100 Million to Revamp Stores

Von Maur will spend more than $100 million over five years to update an unspecified number of its 37 stores to reflect residential design trends like white and cream tones, warm woods and modern lighting. Renovations are underway at the department store’s locations at Towne East Square in Wichita, Kansas; Jefferson Point in Fort Wayne, Indiana; Westroads Mall in Omaha, Nebraska; Laurel Park Place in Livonia, Michigan; Oxmoor Center in Louisville, Kentucky; Corbin Park in Overland Park, Kansas; and Hickory Point Mall in Forsyth, Illinois.

Retail Sales Made for a Mixed Bag in April

U.S. retail and food services sales excluding gas and auto declined 0.1% from March to April, according to the Census Bureau. “Although one month of data points does not provide enough evidence, these figures do point to a possible slowdown in consumer spending,” said ICSC research manager Matthew Panfel. Sales did rise 3.5% year over year in April, though at a slower pace than March’s 4.5% year-over-year growth. Clothing, electronics and food-and-beverage stores reported the strongest gains from March to April, while nonstore retailers; sporting goods, hobby, book and music stores; and health and personal care stores declined the most.

Luxury Rents Have Climbed in Europe as Big Brands Snapped Up Retail Space

Europe’s top luxury retail corridors boasted exceptional occupancy rates and robust rents in 2023, fueled by surging demand from fashion brands seeking prime locations, according to Cushman & Wakefield’s European Luxury Retail 2024 report. High streets like Via Monte Napoleone in Milan, Avenue des Champs-Élysées in Paris, Bond Street in London and Passeig de Gràcia in Barcelona continue to draw interest from luxe labels like Cartier, Chanel, Gucci and Louis Vuitton.

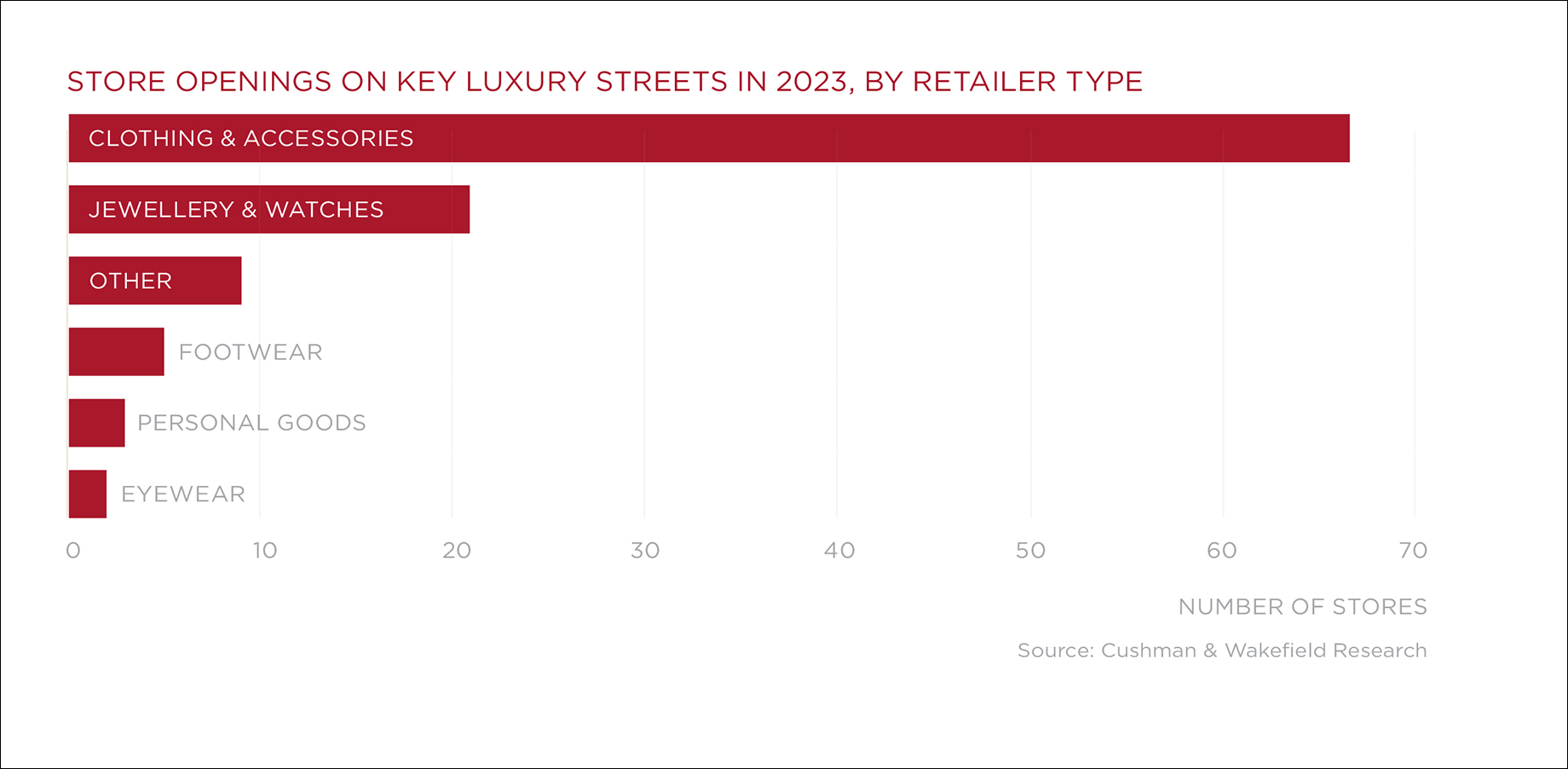

In 2023, 107 stores opened on 20 key luxury streets across 16 cities. Fashion accounted for a significant chunk of store openings, making up 60% of those openings. Brands owned by LVMH, Kering and Richemont — the three largest luxury conglomerates by sales, according to Cushman & Wakefield — accounted for a third of the 107 openings.

As retailers compete for coveted locations on prime luxury streets, rents keep climbing. Cushman & Wakefield tracked 20 such streets in 2023, finding 16 with vacancy rates below 5%, including seven with no vacancies. This scarcity, coupled with a surge in demand for bigger stores, is prompting developers to create more luxury retail spaces with larger footprints, the firm reported.

Average annual rent growth for Europe’s luxury streets reached 3% in 2023, compared with only 1.6% average rental growth for all European high streets, according to the report. And there’s room for higher rents still, especially on key European luxury streets. The firm expects average annual rental growth of 1% to 2% through 2027.

At the same time, luxury brands and conglomerates are looking beyond retail operations and are acquiring real estate as strategic long-term assets, according to Cushman & Wakefield. And they’re not just renting anymore; they’re buying buildings and putting major renovations into creating flagship stores that solidify their brand images, especially in London, Milan and Paris.

C-Suite Updates at RD Management

RD Management has hired Michael Carroll as co-CEO. Carroll is a 30-year industry veteran who helped found ShopOne, served as CEO of Centro Properties Group and helped the company go public as Brixmor. Richard Birdoff, who has worked for the company for over 30 years and has led the company since 2015, will become executive chair and will serve as co-CEO.

John Hayes also has joined RD Management, as CFO. He previously spent more than 16 years as CFO with Urstadt Biddle Properties, which Regency Centers recently acquired. Hayes will replace Isana Radchik, who will retire in July after 35 years at the company.

By Brannon Boswell

Executive Editor, Commerce + Communities Today