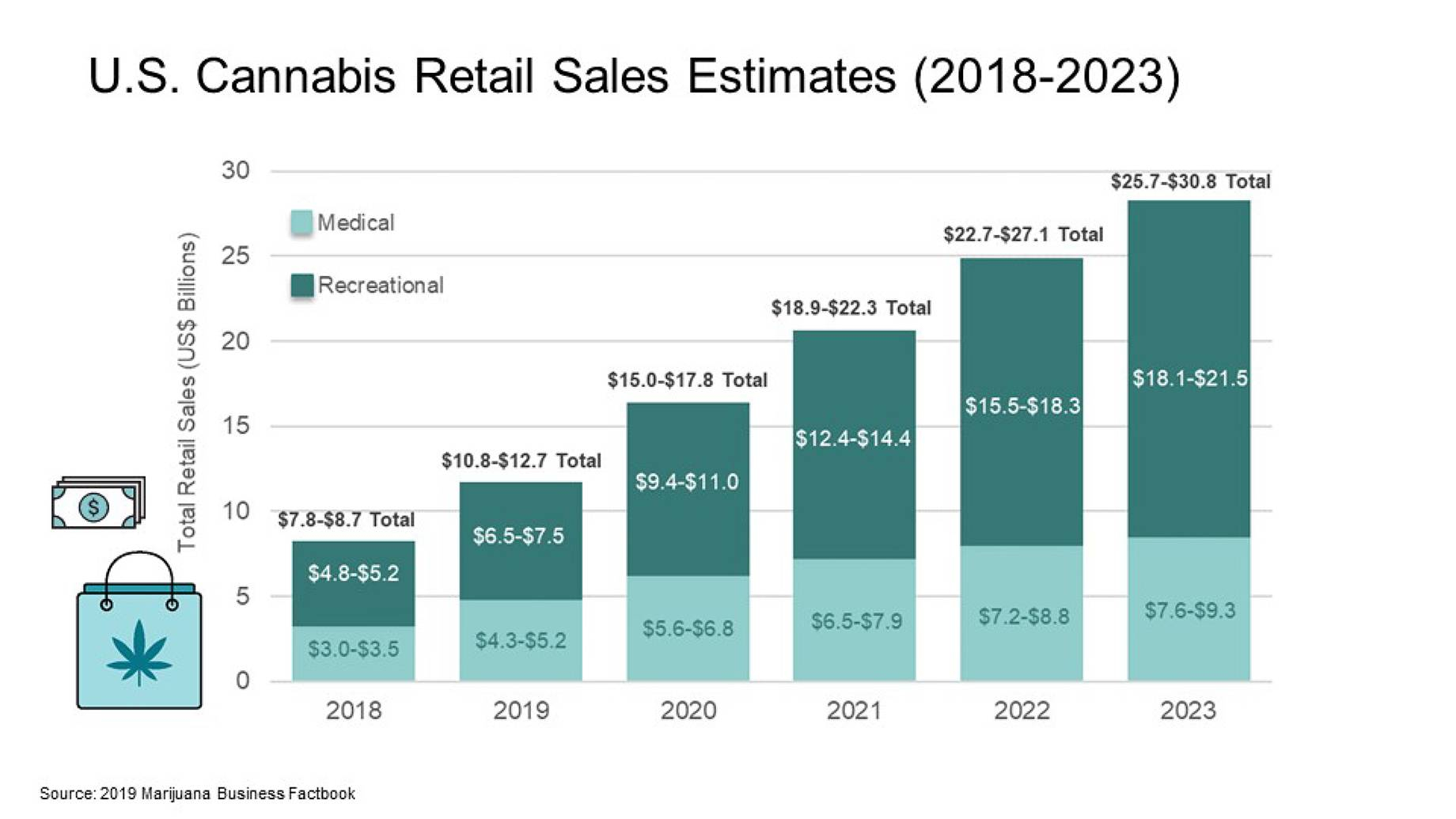

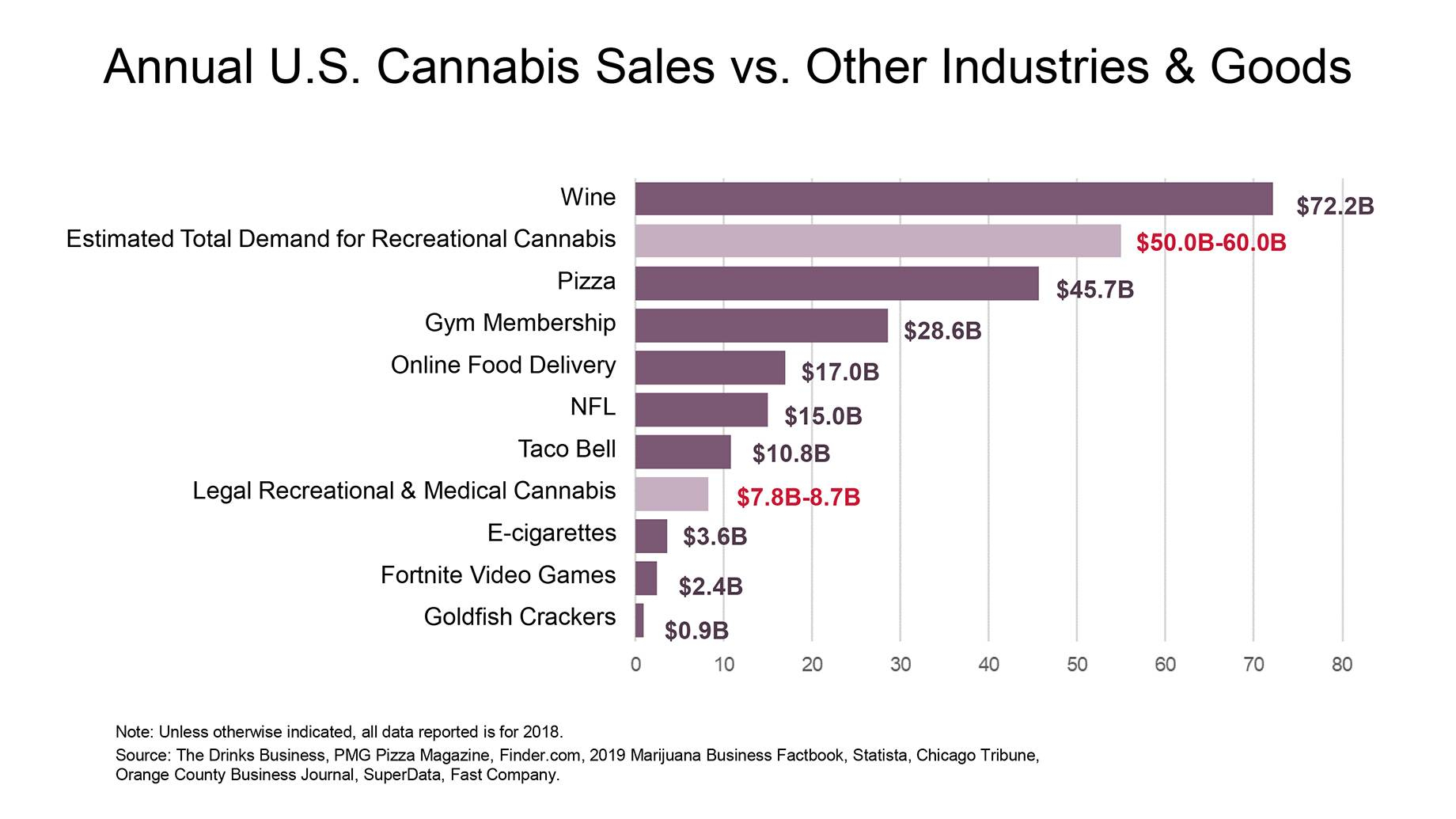

After the COVID-19 crisis subsides, cannabis will continue to be one of the biggest growth categories in the retail industry, and it will rely on physical stores for expansion, experts said on an ICSC webinar called Cannabis Tenants: Evaluating an Emerging Use. “It’s the fastest growing segment of the retail industry,” said Mike Demetriou, president of Baum Realty Group. “It’s bigger than pizza, gym memberships and the NFL.”

James Burns — vice chair and CEO of Alcanna, which operates 255 liquor stores and 31 Nova Cannabis stores in Canada — said, “Cannabis retail will be heavily focused on bricks-and mortar for a long time.” Only 20 percent of Canadian adults use cannabis, he said, compared with the 80 percent who drink alcohol. “There’s lots of room for growth.”

Brick-and-mortar, rather than e-commerce, will best reach those who have never used cannabis regularly, Burns said. “Most of our new customers are in their 60s and 70s, and they want to talk to someone. They don’t know the product.” Cannabis still has a huge stigma, he added. “Online delivery is hard because you have to give your name and credit card number. We do a lot of cash business in our stores.”

Even so, landlord resistance to cannabis retail has disappeared in Canada, he said. Many of his company’s cannabis stores are in supermarket-anchored shopping centers.

U.S. landlords, though, remain tough to convince, said Demetriou. CBD stores may be popping up in U.S. malls and open-air centers, but full-on dispensaries are tougher to sell to landlords. And most mortgage REITs don’t allow the use, he said. “Cannabis retailers must either own the property themselves or find a non-institutional owner or sympathetic partner to do a sale-leaseback deal. It’s a little challenging to play in this space.” Even when a suitable property is found, licensing can lengthen closing on a cannabis real estate deal by months, said Bridget Hill-Zayat, attorney for Hoban Law Group.

The results can be well worth the effort, however. “I know of one dispensary that does $3.5 million a month,” Demetriou said. “The average Chipotle does that much in a year.”

The webinar is available here (Chrome works best).

Click to read about and listen to other recent webinars from ICSC

10 communication tips to prepare for reopening

Which tech tools are best for remote work?

How to access government cash

Next steps for job seekers

Smart restaurants are prepping for new normal

Transparency key to leadership in a crisis

How to ask a lender for relief

Government loans that can help small businesses during COVID-19

Communications are key for retail centers’ pandemic response

By Brannon Boswell

Executive Editor, Commerce + Communities Today