Developer Will Reimagine Walmart-Owned Mall Near Pittsburgh

If luxury retailers can do it in New York City, Walmart can do it in Pittsburgh. “Luxury brands have increasingly begun purchasing their flagship locations instead of leasing them,” according to Cushman & Wakefield. Now, Walmart has acquired Pennsylvania’s Monroeville Mall and Annex, and it might open a big-box store there.

Monroeville Mall in October 2010, six years after CBL acquired it Photo: Avicennasis, CC BY-SA 3.0, via Wikimedia Commons

A big makeover is in the works for the 1.2 million-square-foot, 186-acre mall now that it’s under new ownership. CBL had said on Jan. 31 that it sold the property to an unidentified buyer for $34 million in cash. The Pittsburgh Post-Gazette has since identified the buyer as Walmart.

Investor and developer Cypress Equities has said it will manage the property for the new owner and lead a project to “reimagine” it as a retail and commercial hub. Cypress Equities envisions a mix of uses, such as retail, restaurants, entertainment, residential, hospitality, office and public spaces. Tenants listed on the mall’s website include Best Buy, Dick’s Sporting Goods, JCPenney, Macy’s, Barnes & Noble, Cinemark theaters, H&M and Victoria’s Secret. Monroeville Mall opened in 1969, WTAE reported. CBL bought the mall in 2004 from Turnberry Associates for $231.2 million, according to Chattanoogan.com.

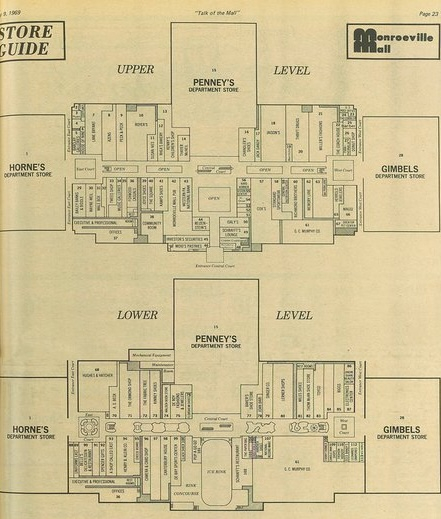

Monroeville Mall store directory in 1969 Photo: Ewborgoyne, CC BY-SA 4.0, via Wikimedia Commons

Canadian Retail REIT Wraps Up $401.5 Million in Acquisitions

Southgate Photo courtesy of Primaris

Primaris has closed two deals collectively valued at $401.5 million for 100% ownership of a center in Ontario and 50% ownership of one in Alberta. Primaris paid a combination of cash and equity for its stakes in Ontario’s Oshawa Centre and Edmonton, Alberta’s Southgate. The price tags added up to the equivalent of 585 million Canadian dollars. Primaris’ portfolio of enclosed shopping centers in Canada spans 15 million square feet.

Oshawa Centre Photo courtesy of Primaris

Barnes & Noble Eyes More Than 60 New Stores in 2025

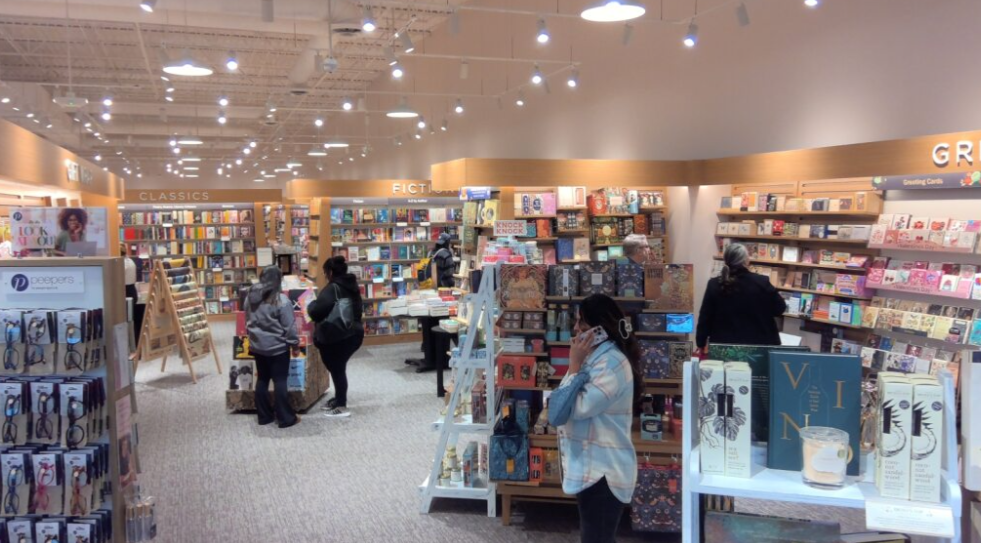

After remodeling, Barnes & Noble reopened its 22,000-square-foot store in Town & Country Village, west of Houston, on Jan. 22. Photo courtesy of Barnes & Noble

In something of a comeback for brick-and-mortar book sales, bookstore chain Barnes & Noble expects to open more than 60 new stores this year. Barnes & Noble opened a record-setting 57 new stores in 2024, up from 30 in 2023, according to Axios and Fast Company. It “is experiencing strong sales in its existing stores and has been opening many new stores after more than 15 years of declining store numbers,” the retailer told Fast Company. Four new locations already have opened in 2025, and leases are signed for another 37, according to Fast Company. Barnes & Noble operates about 600 stores.

Beyond Inc. Will Purchase BuyBuy Baby for $5 Million

Photo credit: Ken Wolter/Shutterstock.com

Reuniting the Bed Bath & Beyond retail brand with BuyBuy Baby may result in a brick-and-mortar return for the children’s specialty retailer. Beyond Inc. — which owns the Bed Bath & Beyond, Overstock and Zulily retail brands — agreed to buy global rights to the BuyBuy Baby brand from BBBY Acquisition Co. LLC for $5 million. Beyond said it and omnichannel partner Kirkland’s think BuyBuy Baby “has a strong future both online and in brick-and-mortar,” stating that BuyBuy Baby could operate standalone locations or be incorporated into Bed Bath & Beyond home goods stores. In 2024, BuyBuy Baby closed its 10 stores and switched to an online-only sales model, according to CNN.

Korean Beauty Products Retailer Enters U.S.

An Olive Young store in Gangnam in Seoul, South Korea, in March 2024 Photo credit: moomusician - stock.adobe.com

A Korean beauty products retailer is breaking into the U.S. market. South Korea’s CJ Olive Young said on Tuesday it has set up its first U.S. subsidiary, which is based in Los Angeles, according to The Korea Times. The company is scouting locations for its first U.S. store. Olive Young competes in the fast-growing market for Korean beauty products. Citing Korea’s Ministry of Food and Drug Safety, The Korea Times reported that exports of Korean cosmetics to the U.S. jumped by more than 20% each year from 2020 to 2023. As of June 2024, Olive Young operated more than 1,350 stores.

Walmart Reveals $4.5 Billion Expansion in Canada

A Walmart in Kanata, Ontario, in June 2024 Photo credit: Iryna - stock.adobe.com

Walmart has launched a nearly $4.5 billion Canadian expansion. Walmart Canada will build dozens of stores over the next five years, starting with five in Ontario and Alberta by 2027. The investment, equivalent to 6.5 billion Canadian dollars, “is the largest we’ve made in Canada towards expanding our footprint since we first arrived here 30 years ago,” said Gui Loureiro, Walmart regional CEO for Canada, Chile, Mexico and Central America. The expansion also will involve the modernization and addition of distribution space. Walmart is wrapping up a $2.4 billion program unveiled in 2020 to build new stores, update existing stores and add distribution centers in Canada. The retailer operates more than 400 Canadian stores.

Bargain Hunt Is Closing All 92 of Its Stores Following a Bankruptcy Filing

Photo courtesy of PR Newswire / Hilco Consumer - Retail

Following its Chapter 11 bankruptcy filing, discount retailer Bargain Hunt is shutting down all 92 of its stores in the U.S. Essex Technology Group, which does business as Bargain Hunt, filed for bankruptcy on Monday. The largest unsecured creditor is e-commerce giant Amazon, which is owed more than $29 million, according to Home Textiles Today. Bargain Hunt, founded in 2004, has promoted itself as an “extreme value retail chain” selling high-quality closeouts, buyouts, overstocks and returns at 30% to 70% off everyday retail prices. Among the items it sells are food, beverages, pet supplies, bedding, home decor, furniture, toys and electronics. The chain’s stores are supposed to close by the end of February.

Changes at HFA and MCB Real Estate

Cannon McNair has been promoted to the newly created position of chief strategy officer at HFA. The architecture and engineering firm specializes in in retail and other commercial real estate sectors. McNair, who joined the firm in 2019, most recently served as director of brand and marketing.

Cannon McNair Photo courtesy of PR Newswire / HFA Architecture + Engineering

And institutional investment management firm MCB Real Estate, whose nationwide portfolio totals 15 million square feet, has acquired asset management and property management Pinkard Properties and its 14-member team. MCB focuses on industrial, mixed-use, multifamily, retail and science and health properties, and Pinkard Properties’ portfolio encompasses 2 million square feet of office, industrial and retail in Maryland.

Pinkard Properties co-founder Katherine Pinkard is now senior managing director of property management for MCB Real Estate. MCB’s current property management leader, vice president Marty Lastner, recently announced plans to retire.

Katherine Pinkard Photo courtesy of MCB Real Estate

By John Egan

Contributor, Commerce + Communities Today