Tanger, a REIT that owns and operates outlet centers, has purchased its third center serving the full-price market. It scooped up the 640,000-square-foot, Whole Foods-anchored Pinecrest in the Cleveland suburb of Orange for $167 million. The deal includes the property’s residential and office components. Pinecrest opened in 2018. Tanger’s portfolio now comprises 42 retail centers in the U.S. and Canada spanning more than 16 million square feet.

Pinecrest tenants include REI, Williams Sonoma, Pottery Barn, Nike, Silverspot Cinema, Pinstripes, Shake Shack and Firebirds Wood Fired Grill. Photos above and at top courtesy of Tanger

Tanger acquired Huntsville, Alabama’s 825,000-square-foot Bridge Street Town Centre in late 2023 for $193.5 million and Little Rock, Arkansas’s 270,000-square-foot Promenade at Chenal in late 2024 for $70 million. Tanger categorized all three of these non-outlet properties as “market dominant.” They’re open-air centers with high street designs, serve affluent communities and include market-exclusive retailers. Tanger also emphasized that each offers shopping, dining and entertainment.

The REIT used cash and available liquidity for all three purchases. It said at the time of each purchase that it expected a first-year return of 8%.

Pinecrest’s AC by Marriott hotel, which features ground-floor retail, has a separate owner. Photo courtesy of Tanger

Loblaw Cos. Unveils $1.55 Billion Expansion Plan

A No Frills store in Richmond Hill, Ontario, in October 2019 Photo credit: JHVEPhoto - stock.adobe.com

Canadian grocery store and drugstore operator Loblaw Cos. has earmarked $1.55 billion to open 80 locations, renovate more than 300 locations and open a 1.2 million-square-foot distribution facility an hour north of Toronto in 2025. The investment is equivalent to 2.2 billion Canadian dollars. The new stores will fall under the No Frills, Maxi, Shoppers Drug Mart, Pharmaprix and T&T Supermarket banners. Overall, Loblaw Cos. envisions spending about $7 billion, equivalent to 10 billion Canadian dollars, to grow its presence over the next five years. Loblaw Cos. operates 2,500 stores across Canada.

Loblaw Cos.’ move comes on the heels of Walmart Canada’s announcement of a nearly $4.5 billion expansion plan, including the opening of dozens of stores over the next five years. Walmart’s investment is equivalent to 6.5 billion Canadian dollars.

NFL Legend Emmitt Smith Backs New Center in South Carolina

413 Solutions’ Emmitt Smith Photo courtesy of 413 Solutions

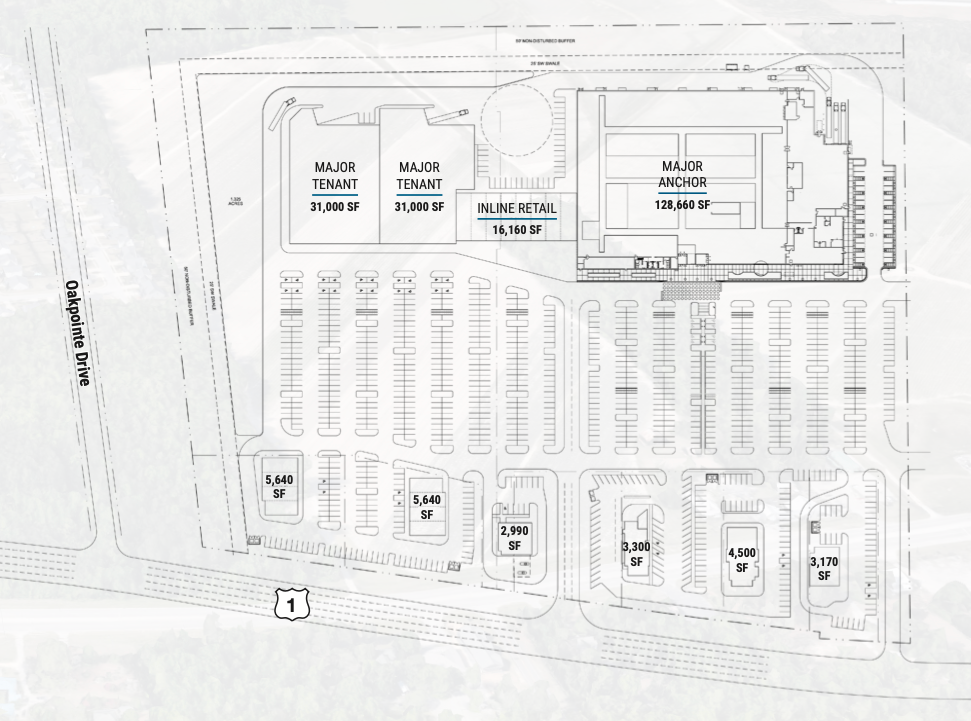

NFL Hall of Famer Emmitt Smith is backing a new Target-anchored retail center in Lexington, South Carolina, which is part of the Columbia metro area.

Image courtesy of 413 Solutions

It’s the first project for 413 Solutions, whose co-founders are David Mosley and Smith, a former running back for the Dallas Cowboys. A spokesperson for the company told C+CT that the more than 230,000-square-foot, 27-acre project is scheduled to break ground this month. Completion is set for the fall of 2026.

Image courtesy of 413 Solutions

Food-and-Beverage Is Outperforming in Store Openings

The food-and-beverage sector is bucking the store-closure trend in the U.S. JLL’s United States Retail Outlook Q4 2024 report shows that from the beginning of 2024 to now, 2,977 restaurant openings and 848 restaurant closures had been announced. The 917 grocery store openings announced also far outweigh the 63 grocery store closures announced. F&B services also accounted for 21% of retail leasing activity from January to November 2024, while food-and-beverage stores carved out an 11.6% slice of retail leasing activity.

Salt Lake City’s Retail Rents Grew the Most in 2024

Salt Lake City is spicing up retail leasing. Utah’s capital ranks first for year-over-year growth in retail asking rents in 2024, according to Coldwell Banker Commercial’s 2025 Outlook Report, which cited CoStar data. A Coldwell Banker spokesperson said CoStar’s retail data covers 177 metro areas in the U.S. “Retail tenant activity remains competitive across all [of our] markets due to very limited inventory, low vacancies and robust consumer spending,” the Coldwell Banker Commercial report said. “Strong demand for fast-casual, professional services, grocery and value retail is pushing rents and property prices higher across our markets.”

Top Markets for U.S. Retail Asking Rent Growth in 2024

| Salt Lake City | 9% |

| Phoenix | 6.6% |

| Tucson, Arizona | 6.1% |

| Columbus, Ohio | 5.1% |

| Jacksonville, Florida | 5% |

| Dayton, Ohio | 4.9% |

| Norfolk, Virginia | 4.9% |

| Greenville, South Carolina | 4.8% |

| Las Vegas | 4.7% |

| Raleigh, North Carolina | 4.6% |

Source: Coldwell Banker Commercial’s 2025 Outlook Report, citing CoStar data

Development Is Complete at the Massive Shops at Hollywood Park

Photo credit: Adrian Tiemens Photography

Work has wrapped up on the Shops at Hollywood Park, an 890,000-square-foot retail center adjacent to SoFi Stadium and YouTube Theater in Los Angeles’ Inglewood suburb. Construction started in 2021, according to L.A. Business First. A number of businesses have already opened, including a 56,000-square-foot Iconix Fitness.

Cinépolis, Hollywood Park’s first retail tenant, opened in 2023 and is billed as the L.A. area’s first dine-in Imax theater. Photo credit: Adrian Tiemens Photography

The billionaire owner and chair of the NFL’s Los Angeles Rams, Stan Kroenke, owns and operates the nearly 300-acre Hollywood Park, which he developed on the site of the former Hollywood Park racetrack.

FROM C+CT IN 2023: New Sports Venues and the Master-Planned Districts Growing Around Them

The Downtown Dallas Neiman Marcus Will Close Next Month

Downtown Dallas Neiman Marcus in May 2006

Photo credit: 020808 at the English-language Wikipedia, CC BY-SA 3.0

Dallas is losing a retail landmark. Parent company Saks Global said it’s shutting down the iconic Neiman Marcus store in downtown Dallas on March 31, Retail Dive reported. Saks Global also is closing its Neiman Marcus headquarters in Dallas, according to Forbes. The flagship store, which contains more than 100,000 square feet of retail, opened in 1914 and is a designated historic landmark.

Although Saks Global is shuttering the downtown Dallas store, it’s allocating $100 million for renovation of the Neiman Marcus store at NorthPark Center in North Dallas, according to Retail Dive. Including the soon-to-close flagship location, Neiman Marcus operates 36 stores.

Saks Global is the corporate entity established after Saks Fifth Avenue parent HBC purchased Neiman Marcus Group last year in a deal valued at $2.7 billion.

Davon Barbour Becomes CEO of Downtown Austin Alliance

Davon Barbour became the CEO of the Downtown Austin Alliance on Thursday, succeeding longtime CEO Dewitt “De” Peart, who recently retired. The nonprofit seeks to preserve and improve the vitality of downtown Austin, Texas. Barbour, an ICSC trustee, had served as president and CEO of the Downtown Development District of New Orleans since 2021, and he has held similar jobs in Baltimore, Miami, Orlando and Los Angeles.

MORE FROM C+CT: Davon Barbour’s Unwavering Faith in Urban Placemaking

By John Egan

Contributor, Commerce + Communities Today