Prime retail space is at a premium, retailers said at the ICSC@SOUTHEAST event in Atlanta last week. Supply is tight just as direct-to-consumer brands enter brick-and-mortar and as others expand their footprints.

Ace Pickleball Club has signed up 60 franchisees and is running into headwinds seeking suitable, large-format spaces for them to lease, according to chief growth officer Diego Pacheco. “You’re out there battling for big-box spaces. It’s really challenging, especially for a nontraditional use.” Since starting the process in May, the company has signed seven leases and plans to have 18 more signed by year’s end.

The tight supply means landlords have an opportunity to up rents, said JP Suarez, former executive vice president, regional CEO and chief administration officer for Walmart International. “There’s not a lot of stuff being built, so the stuff that’s available is being absorbed very well.” Suarez serves on the board of directors of landlord Brixmor and said he has seen the company benefit from the market conditions. “The industry was overbuilt for quite a few years,” he said. “That overbuilding has stopped, and the demand has caught up. You’re seeing some pressure and competition for space.”

At the very moment that space is hard to find, retailers view expanded brick-and-mortar presences as key to growing their sales, according to Telsey Advisory Group chief research officer and CEO Dana Telsey. “Physical retail offers a chance to differentiate a retailer’s brand. Retail real estate is hugely important in acquiring new customers and acquiring more wallet share from existing customers.” Direct-to-consumer retailers like scrubs maker Figs and jewelry brand Princess Polly are opening their first physical stores, she said. Meanwhile, stalwarts like Abercrombie and Victoria’s Secret have shown renewed commitment to upgrading their fleets of stores with new technology and designs that appeal to different demographics. And a new generation of specialty apparel retailers like Veronica Beard, Faherty and Vuori is adding stores rapidly, she added.

For its part, Walmart will open some 20 U.S. stores this year, Suarez said. Stores are giving customers an immersive experience but also serving as hubs for online and delivery orders, he added. “Walmart is asking stores to play both functions. Front-of-store still matters, but back is used not just for holding product for dispensing, packing, shipping. A number have expanded pickup locations. More stores are going to have to do more of both.” Costco, too, is using stores to fulfill online orders, said Daniel Venable, senior vice president at Northwest Atlantic Real Estate Services, which acts as the real estate adviser to Costco. “At Costco, we are now opening new locations with between 5,000 square feet up to 35,000 or 40,000 square feet of distribution on the backside of it, helping with those last-mile distribution locations.”

Among the other challenges slowing retailers’ expansion plans, according to retailers speaking at the event: escalating construction costs, a lack of cheap land, a lack of human talent and municipal permitting delays. But more cities are coming forward with incentive packages to woo Costco to their regions, Venable said. “Costco is looking at markets that were too small and not strong enough for us 10 years ago,” he said. Now, economic incentive packages are helping it bridge the gap on deals, he added.

Where New Developments Are Happening, and Where Rents Are Growing

New retail construction in the U.S. remains stunted thanks in large part to soaring construction costs and relatively high interest rates. The amount of new retail space delivered fell 28% from the second quarter to the third, to just under 5.6 million square feet. That’s the second-lowest on record, according to CBRE’s U.S. Retail Q3 2023 report. The rolling 12-month total fell for the first time in five quarters, dropping 6% from the second quarter to 29.7 million square feet in the third quarter. According to CBRE, 2023 is on track to be the fourth-consecutive record-low year of new retail development since it began tracking the data.

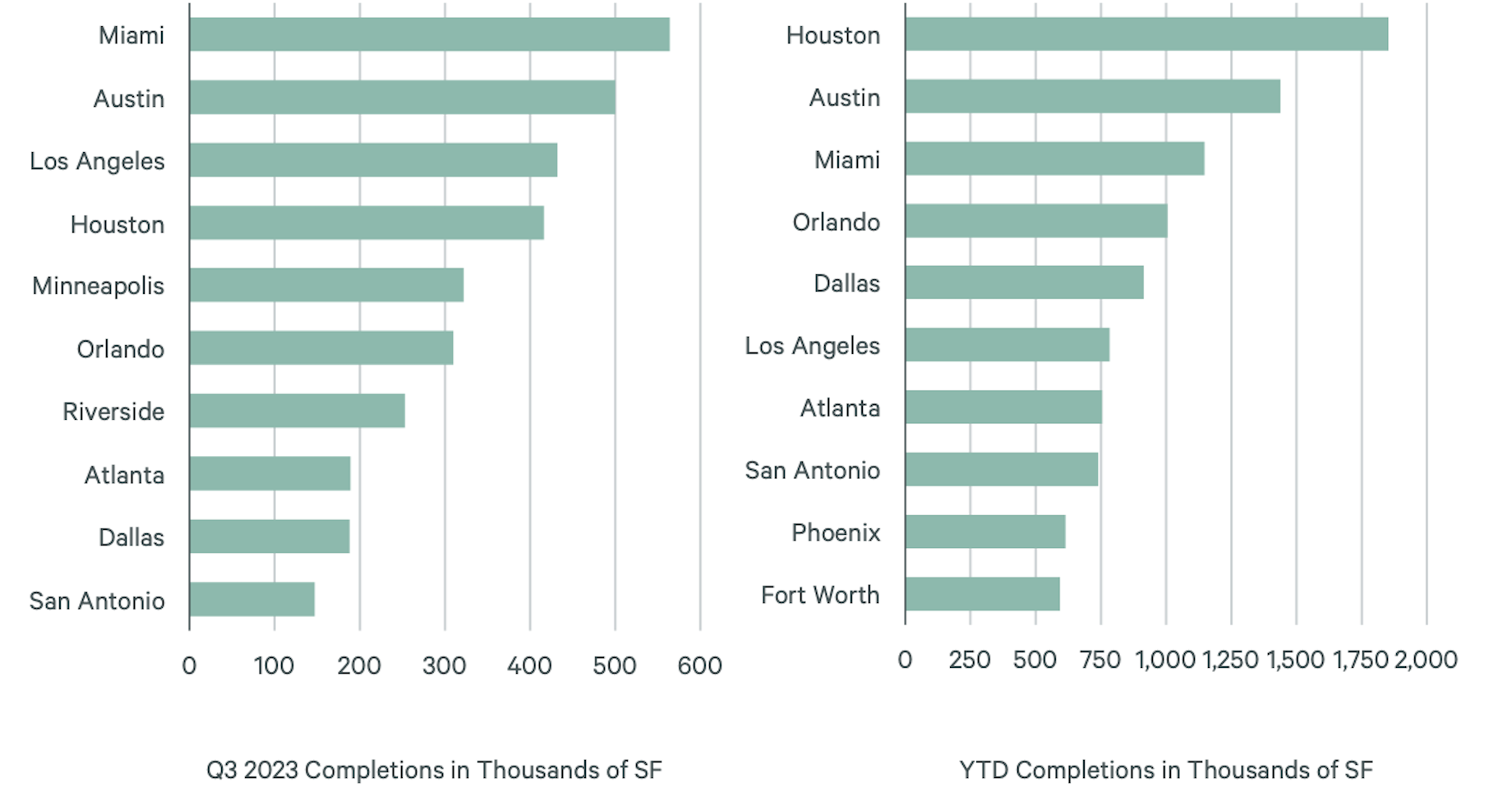

But some builders are forging ahead. Sunbelt regions with high population growth, cheaper land and fewer regulations continue to attract the most cranes and concrete mixers. Miami completed the most new retail construction in the third quarter with 564,000 square feet, according to CBRE. Typical of the kinds of projects that opened is Terra Development’s 78,000-square-foot, Pilates studio-anchored Doral Atrium. The project is adjacent to a 350-unit multifamily property, and tenants include a PNC bank, a Korean fried chicken restaurant, a nail salon, a sushi bar and a shoe store.

Austin was the second-busiest U.S. market, according to CBRE, opening 500,000 new square feet, and Los Angeles opened 432,000 square feet.

Looking at the first three quarters of the year combined, Houston delivered the most new retail space, 1.85 million square feet, followed by Austin with 1.4 million and Miami with 1.15 million. Texas markets accounted for 29% of new retail space, followed by Florida with 17%.

Construction Completions by City in Q3 and Year to Date

Source: CBRE Econometric Advisors

Where Rents Are Growing

With little new construction underway, tenants have to pay more for the best locations. Landlords took the opportunity to raise rents in the third quarter, especially in smaller markets with fewer options for space. Tertiary markets led the way in the pace of asking rent growth from the second quarter to the third, as Westchester County, New York; Wilmington, Delaware; and Richmond, Virginia, all topped 2%, according to CBRE. Year over year, asking rents grew the most in Wilmington; West Palm Beach, Florida; Westchester County; and Bakersfield, California.

Tanger Nashville Opens Today

The first outlet center to break ground and open in the U.S. since 2019 opens today in Nashville. Indeed, it’s one of the few major shopping centers to open since 2019. The 290,000-square-foot Tanger Nashville opens 96% leased to such tenants as Pottery Barn Outlet, ShakeShack and Ulta Beauty. The property brings the outlet REIT’s portfolio to 37 properties.

3 Home and Furniture Stores and 2 Fast-Fashion Retailers Making News

Home decor catalog retailer Ballard Designs continues to mine its catalog subscriber base for store locations, as the company has opened a store in Columbus, Ohio, in a 12,000-square-foot, freestanding building near Easton Town Center. Its sister brand, Frontgate, will open in the same building in the coming months. Ballard Designs has operated a factory outlet store in West Chester Township, Ohio, outside Cincinnati, since 2000. The Columbus location is part of the 40-year-old brand’s ongoing retail expansion. The retailer now tallies 18 stores, including units in Charleston, South Carolina, and Tampa, Florida, that opened this year.

Meanwhile, the lights are off at Z Gallerie. The furniture retailer, owned by home decor conglomerate CSC Generation Holdings, filed for Chapter 11 bankruptcy protection and plans to shutter all 21 stores. CSC bought Z Gallerie out of bankruptcy in July 2019.

HomeGoods has pulled the plug on its e-commerce business after just two years. The company closed the e-commerce function on the site on Oct. 21. “We've made the decision to focus our resources on our brick-and-mortar stores,” the TJX Cos.-owned retailer said in an email to customers. At the end of the second quarter, HomeGoods had 907 stores.

Two fast-fashion peers are teaming up to boost sales. China-based online retailer Shein opened its first pop-up, inside the Forever 21 at Ontario Mills mall in Ontario, California. The four-day pop-up was the first across several of Forever 21’s 400 stores this year. In August, Shein bought about one-third of the shares of Sparc Group, which owns Forever 21. Sparc Group now owns a small stake in Shein. Sparc Group is a joint venture between Ontario Mills owner Simon and brand licenser Authentic Brands Group.

Share news and story ideas with C+CT executive editor Brannon Boswell at bboswell@icsc.com.

By Brannon Boswell

Executive Editor, Commerce + Communities Today