Though many are inclined to pit e-commerce against physical retail, those retailers that offer their customers both options — a choice of shopping online and in stores — tend to boost sales in both arenas, a new ICSC study indicates.

The report underscores the value for retailers to invest in omni-channel platforms and for e-tailers to open stores. Omni-channel consumers represent just 17 percent of all customers, but they account for 34 percent of total spending, according to the study, titled The Halo Effect II: Quantifying the Impact of Omnichannel.

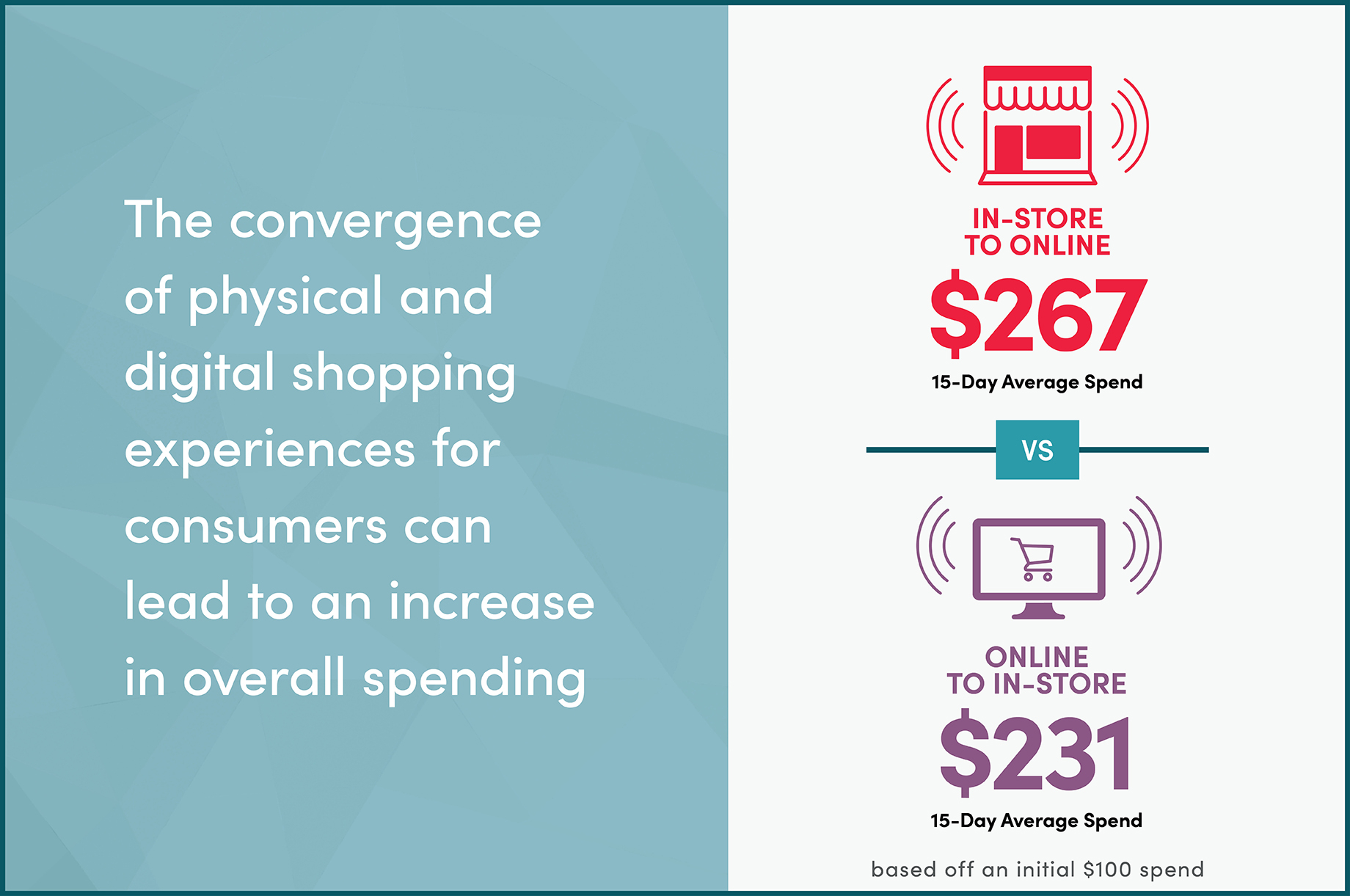

So just how much does a customer spend online after shopping in a store, or vice versa? Those who shopped first at a store and then went to that retailer’s website within 15 days ended up increasing their spend by about 167 percent, on average, according to the study. For instance, a person spending $100 in a store then went on to spend an additional $167 online from that retailer, for a total expenditure of $267 within that time period. Conversely, a customer spending $100 online who then followed up with an in-store purchase spent a total of $231 during that time period.

Omni-channel consumers represent just 17 percent of all customers, but they account for 34 percent of total spending

An earlier ICSC study — The Halo Effect: How Bricks Impacts Clicks — showed how stores drive sales to retailers’ websites. This latest study quantifies how much is spent by shoppers moving in both directions — store to website and vice versa.

“Our first Halo report demonstrated the positive correlation between having both a physical and digital presence as it relates to web traffic and brand awareness; this follow-up report puts a dollar amount on that relationship,” said Tom McGee, president and CEO of ICSC. “What we found was that consumers take advantage of the channels available to them, and it has a positive impact on total sales. Simply put, consumers want a great experience — whether it is online or in the store.”

Discount department stores saw the highest in-store spending average, at 96 percent, versus online, at 4 percent

Most “halo” spending takes place shortly after the initial purchase: totaling an average of $250 within five days after an initial $100 expenditure in a store, and rising to an average of $263 by the 30th day.

Sales at physical stores account for nearly nine out of 10 retail dollars spent today, the report says. There were significant differences in spending behavior across the seven retail categories the study covers. For instance, discount department stores saw the highest average in-store spending, at 96 percent, versus online, at 4 percent. And when online-only retailers go on to open physical stores, about 60 percent of the purchases made subsequently tend to occur in those stores.

The ICSC analysis covered some $31 billion in consumer spending for 2016 through 2018 and was taken from the records of roughly 41 million debit and credit card holders.

In terms of frequency, halo shoppers completed 2.1 in-store transactions within 15 days of an online purchase, on average. Conversely, after an initial purchase in a store, halo customers made 1.3 online transactions within that time period, on average.

By Edmund Mander

Director, Editor-In-Chief/SCT