Drugstores are introducing dental services to capitalize on trends in the market. More seniors are able to afford dental services, and more brands are competing for market share in the space.

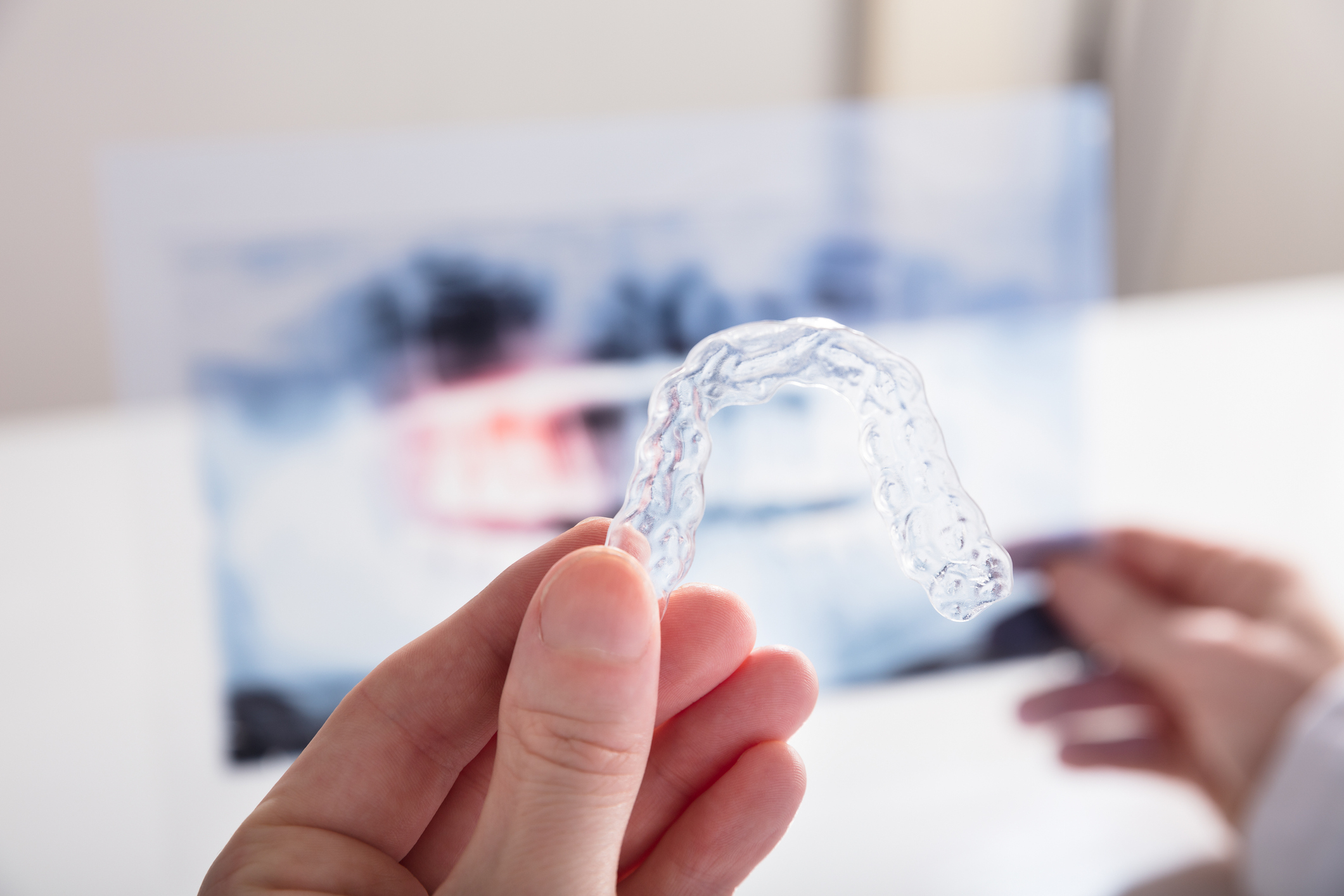

CVS, for one, is testing a venture with teeth-straightening-kit maker SmileDirectClub to fit customers for braces, in six of the retailer’s stores. The teeth-straightening market has become extremely competitive since 40 of market leader Invisalign’s patents expired in October 2017. SmileDirectClub, Candid Co. and other startups are opening their own stores and seeking space on other retailers’ shelves. Candid Co., for its part, has nine of its own stores in Boston, Los Angeles, New York and other cities, while SmileDirectClub operates about 200 units.

Last month, meanwhile, Walgreens opened its first Aspen Dental unit, inside its Palatka, Fla., store. These companies plan to open at a second location sometime during the second quarter.

Adding a dental office “ties in nicely” with Walgreens’ strategy, said Pat Carroll, Walgreens' chief medical officer, as reported by CNBC. More private Medicare plans are starting to offer dental coverage, so with more seniors getting insurance, Walgreens figures it can convert them to dental customers when they come in for their prescriptions.

“The demographic is really looking for dental services; as their dentist may retire, they’re looking for more access,” Carroll said. “We’re also looking at a demographic that’s really using Walgreens and the services they need at our stores.”

By Brannon Boswell

Executive Editor, Commerce + Communities Today