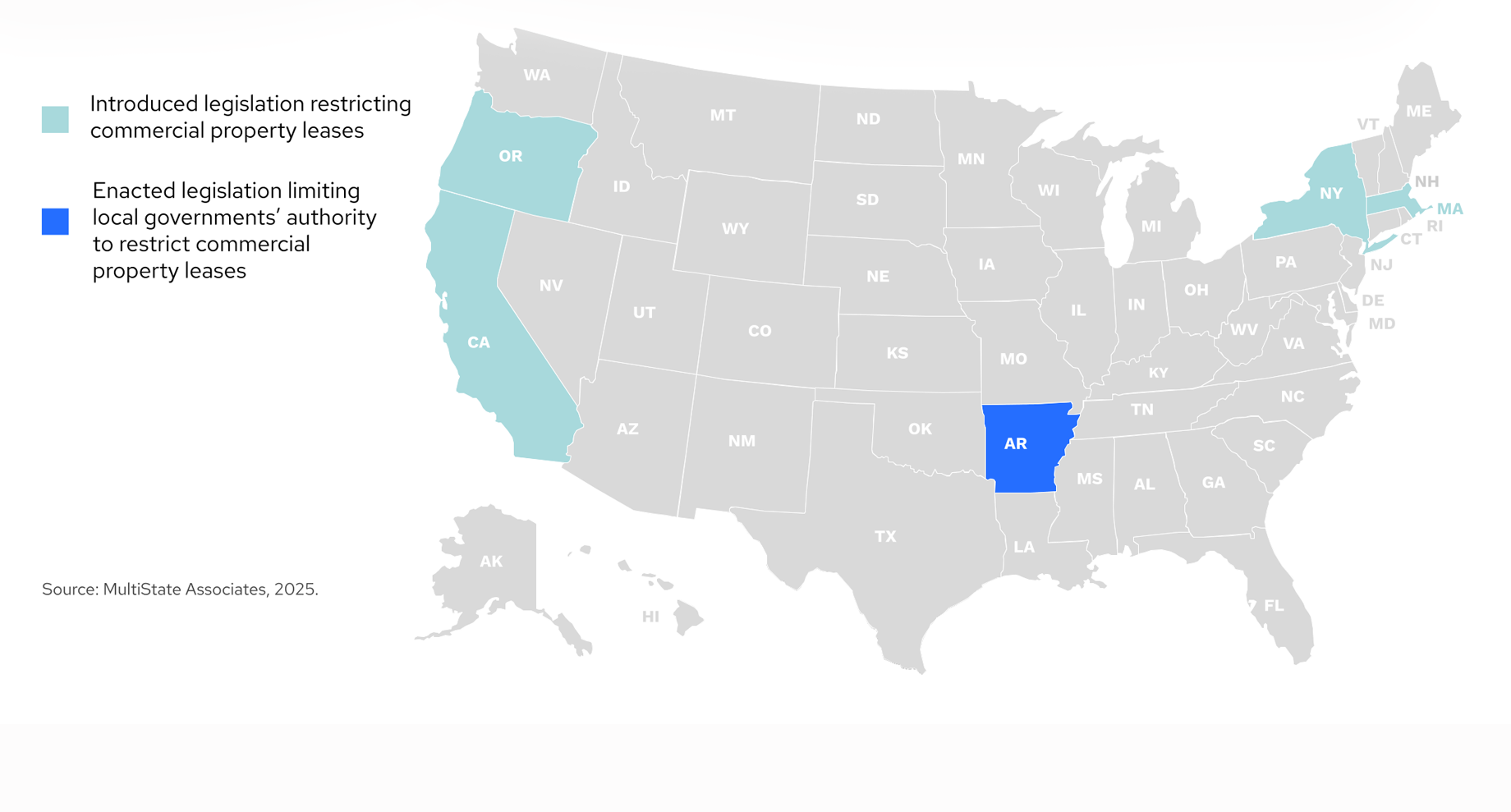

This week, Arkansas lawmakers sent a sweeping bill (AR SB 91) to the Governor’s desk that protects commercial property landlords from being subject to local controls over the amount of application fees and security deposits they charge. Governor Sarah Huckabee Sanders (R) has until April 6 to either sign or veto the bill.

The move from Arkansas comes as lawmakers from four Democratic-controlled states – California, Massachusetts, New York and Oregon – consider eight bills this year restricting how commercial leases are structured. While each bill varies in scope, most measures attempt to regulate rent increases or require landlords to provide tenants with advance notice when selling properties.

In New York, lawmakers are considering several bills targeting commercial leases statewide and specific to New York City. A bill introduced in the Assembly (NY AB 5568) would establish a nine-person mayor-appointed board to oversee a commercial rent control system in New York City. While two bills in the Senate and Assembly (NY SB 421 and NY AB 2611) would force commercial landlords statewide to rent vacant property at a fair market value or the most recent previous tenant rate, whichever is lower.

In California, the recent Los Angeles wildfires have opened the door for lawmakers to consider measures targeting commercial leases. Last month, Assemblymember Mark Gonzalez (D) introduced AB 380, which would limit rent increases to 10% in declared emergencies. In a committee hearing on AB 380, Skyler Wonnacott with California Business Property Association (CBPA) testified that "while well-intended, the bill prevents property owners from adjusting rents, even as their costs — like property taxes, insurance, and maintenance — keep rising."

And finally, a bill introduced in Massachusetts (MA HB 306) would establish a right of first refusal for tenants to purchase the property. The bill also states when property owners should give notice to the tenants of the building when the property is planned to be sold.

State lawmakers are asserting themselves in an issue space typically reserved for local governments. Last year, California lawmakers enacted major legislation (CA SB 1103) that contained several restrictions on commercial leases, such as an increased notice time for rent increases, limits on the amount landlords can recoup during a tenant’s lease for building expenses and requiring leases to be translated into the tenants’ preferred language.

Proponents of measures like California’s SB 1103 claim these policies are needed protections for small businesses in underserved communities. The business community and property owners, meanwhile, say these measures raise the cost of doing business and put landlords in an untenable position if tenants are allowed to rescind leases for minor errors in translating lease agreements.