Charging Ahead: EV Stations Could Transform Retail Revenue and Foot Traffic

Electric vehicle charging stations are more than just green perks; they’re lucrative investments that can boost brick-and-mortar foot traffic and revenue by 4% to 5%, according to Colliers.

This can be achieved through monthly subscriptions that offer guaranteed charging times and priority access while customers shop. Additionally, retailers can charge customers based on the electricity used, applying a markup for profit. Partnerships with EV manufacturers or charging service providers could lead to promotional offers and loyalty programs for EV drivers. These incentives would encourage longer visits, according to Colliers national director of retail services and practice groups Anjee Solanki.

“As consumer adoption of EVs accelerates, businesses that offer charging stations stand to benefit significantly,” she said. “EV owners are more likely to shop with brands that provide on-site charging stations. This trend presents a substantial opportunity for retailers to attract and retain environmentally conscious customers.”

The cost of installing EV charging stations should not be a deterrent. Most retail locations across the U.S. qualify for federal benefits that can cover 30% of installation costs up to $100,000, according to Colliers. To take full advantage of EV potential, retail centers proactively must consider their power supply and how they manage demand. Some properties may need to upgrade electrical infrastructure or invest in renewable energy sources to power the charging stations sustainably, Solanki said.

Electric vehicles typically take between 30 minutes and several hours to charge. To keep shoppers engaged during this time, retail developers are placing charging stations near amenities like restaurants and cafes. This gives customers a place to relax or dine while their vehicles charge.

REITs and other landlords with big parking lots are already on board. Simon unveiled its first EV charging station in Orlando, Florida, in April 2011, and currently has 1,189 stations at 124 properties. This month, Simon signed a deal with BP Pulse to install and operate some 900 EV charging bays across 75 properties. The first will open in 2026. BP Pulse is adding charging bays near airports and major metropolitan areas and at the company’s branded convenience stores. In 2023, the number of charge points in the BP Pulse network grew by 35% year over year.

Simon signed a deal with BP Pulse to install and operate some 900 EV charging bays across 75 properties. This rendering shows stations placed close to shops and restaurants to help keep EV drivers at the property longer.

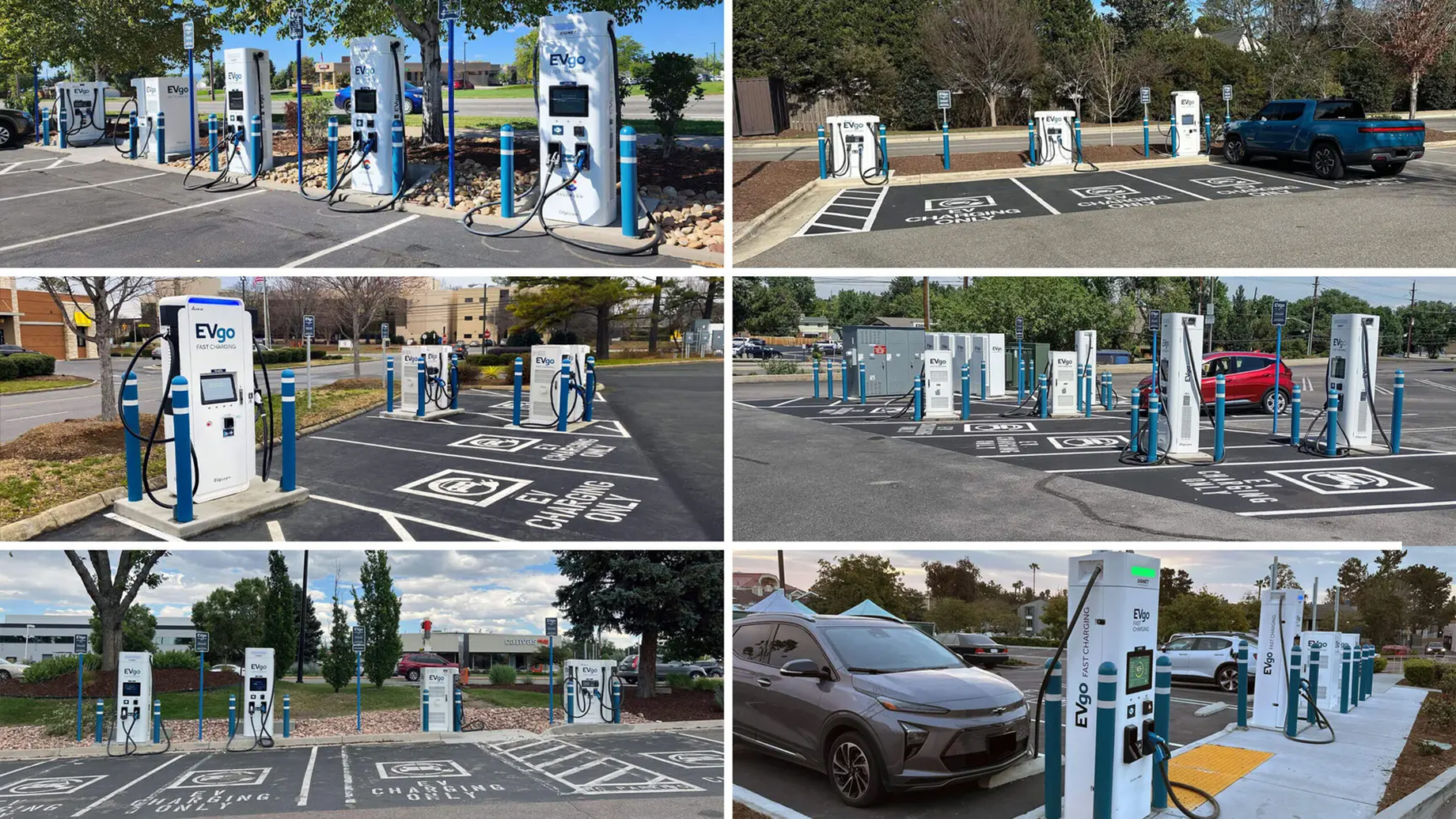

And since 2020, Regency Centers has partnered with EVgo to add 120 charging stalls at approximately 40 properties. Last month, the companies opened a new EV charging station at Blakeney Town Center in Charlotte, North Carolina.

EVgo operates 120 charging stalls at about 40 Regency Centers properties.

Retailers aren’t waiting for landlords to add stations. Target and Walmart, among others, are already adding EV charging stations to parking lots, according to Colliers. Meanwhile, Starbucks placed them at stores roughly 100 miles apart to ensure EV owners can travel long distances comfortably.

More from C+CT

EV Stations Top Investors’ ESG Property Interests

Red States Try to Preempt Local Governments in Setting EV Charging Stations Rules

How Kimco Is Approaching Its EV Charging Station Rollout

LVMH-Backed L Catterton Expands Luxury Footprint

L Catterton, the private equity firm partially owned by luxury retail giant LVMH Moet Hennessy Louis Vuitton, is intensifying its investment in prime retail properties. One of L Catterton’s goals is to gain greater control over top locations for its brands, which range from such famous names as Birkenstock, Boll & Branch and West Marine to growing restaurant chains like Protein Bar & Kitchen and Urban Egg.

To that end, the company bought a stake in outlet mall landlord Value Retail from Hammerson in a deal that values the total firm at $1.9 billion. Value Retail owns and operates nine luxury retail outlets outside major European cities, including Bicester Village in Oxfordshire, England. Hammerson has been pruning its portfolio for years to focus on prime urban locations.

Value Retail plans to open its first U.S. project in September near Belmont Park racetrack and UBS Arena in Nassau County, New York, on Long Island. The 470,000-square-foot Belmont Park Village will include 10,000 square feet of community space, according to the company. Tenants have yet to be announced, but at the company’s European properties, they range from Armani and Gucci to Lululemon and Swatch.

L Catterton also is funding mixed-use projects around the globe, including a joint venture with the owners of Japan’s Tokyu Department Store to open a 1.3-million-square-foot tower in Tokyo’s Shibuya in 2027. The company is on its third real estate fund, with the goal of investing up to $120 million in large-scale, mixed-use projects anchored by luxury retail. It owns stakes in mixed-use properties, including The Amazing Brentwood in Burnaby, British Columbia; South Bay Galleria in Redondo Beach, California; and the Miami Design District.

4 Recent Transactions That Show the State of the Market

Luxury retail properties are in style. Brothers Justin and Tyler Mateen plan to expand the retail portion of a mixed-use property off Rodeo Drive in Beverly Hills, California. The duo purchased the 289,799-square-foot Wilshire Rodeo Plaza from Nuveen for $208 million. The deal includes two multilevel buildings and an underground parking garage. The new owners plan to double the amount of ground-level retail space to 75,000 square feet and spend “tens of millions” upgrading it to attract new luxury retailers. Vera Wang is currently the retail space’s only tenant.

Supermarket-anchored centers are highly favored. Retail Opportunity Investments Corp. sold the 183,292-square-foot Marketplace del Rio in Oceanside, California to 1st Commercial Realty Group for $56.6 million, or $384.24 per square foot. Cushman & Wakefield represented the buyer, while CBRE represented the seller. Stater Bros. Markets anchors the shopping center and has recently signed a long-term lease extension.

Institutions are active buyers and sellers. Fidelity Investments acquired the Lowe’s-anchored, 250,000-square-foot Riverway Plaza in Weymouth, Massachusetts, from Allstate for $23 million. Other tenants include CVS, Michaels and Staples. CBRE represented both the buyer and seller.

Obsolete retail space attracts residential developers. Willard Retail sold the 57,000-square-foot Regal Manassas movie theater, part of Virginia’s 44-acre Parkridge Center, to Hines, for $18.4 million. Hines will develop up to 203 townhomes and condos to replace about half the existing retail space. Willard plans to sell another portion of the property for residential development within the next few years, keeping the 314,000 square feet of existing space that’s occupied by Kohl’s and Old Navy.

Food Halls Are Getting Smaller, More Suburban

The average size of food halls in the U.S. is decreasing as more are opening in secondary locations. A trend that began with large, urban halls in historic buildings is evolving into smaller spaces, according to a new report from Cushman & Wakefield on food halls in Europe and beyond. Developers are adapting the food hall concept to enliven former food courts in shopping centers and mixed-use properties. U.S. food halls dependent on daytime office worker traffic have been less successful than those with robust nighttime crowds, as well. What’s ahead for food halls? Multi-use, flexible spaces where other activities can happen outside of prime dining hours; larger events and collaborations with big brands; in-house breweries, roasteries and farms; a focus on local cuisines and vendors versus chains; and locations in transit hubs that serve specific neighborhoods.

By Brannon Boswell

Executive Editor, Commerce + Communities Today