Warren Buffett seems to believe there is a lot of value in Sears' real estate. That, at least, is one way to interpret the legendary investor's decision to lend Sears landlord Seritage Growth Properties as much as $2 billion.

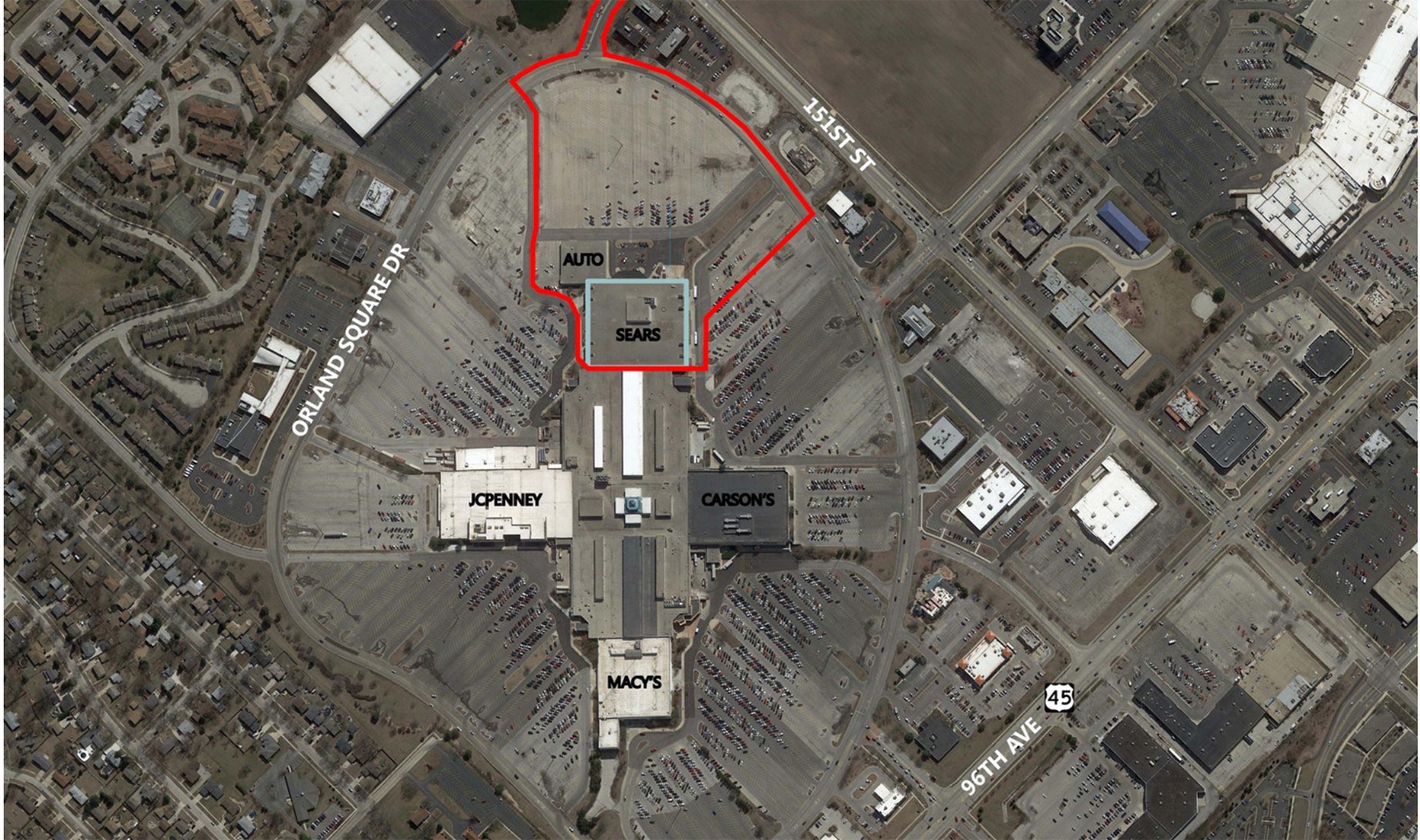

Seritage intends to redevelop a Sears site in Orland Park, Ill., by adding an AMC cinema and an entertainment district

Seritage, a national owner of nearly 250 properties totaling roughly 39 million square feet of gross leasable area in the aggregate, announced today the term-loan facility, with Buffet's Berkshire Hathaway Life Insurance Co. of Nebraska.

As Sears closes stores in its portfolio, Seritage has been repurposing them for mixed uses. The landlord intends to redevelop a Sears site in Orland Park, Ill., for instance, by adding an AMC cinema and an entertainment district.

“This new financing is a transformational step in the evolution of our company, which we started three years ago and positions us to further accelerate our role as a leading retail and mixed-use developer across the country,” said Seritage President and CEO Benjamin Schall. “We very much appreciate Berkshire Hathaway’s confidence in our team and platform and are energized by our growing opportunities to create lasting value for our shareholders, partners and local communities.”

The $2 billion facility, which matures on July 31, 2023, provides for an initial funding of $1.6 billion at closing and also includes a $400 million incremental-funding facility. The amounts bear interest at a fixed annual rate of 7 percent.

Seritage has already used a portion of the proceeds from the loan to fully repay an outstanding mortgage loan and an unsecured term loan.

Buffett is a top shareholder in Seritage, owning about 5.7 percent of the REIT's outstanding shares.

By Brannon Boswell

Executive Editor, Commerce + Communities Today