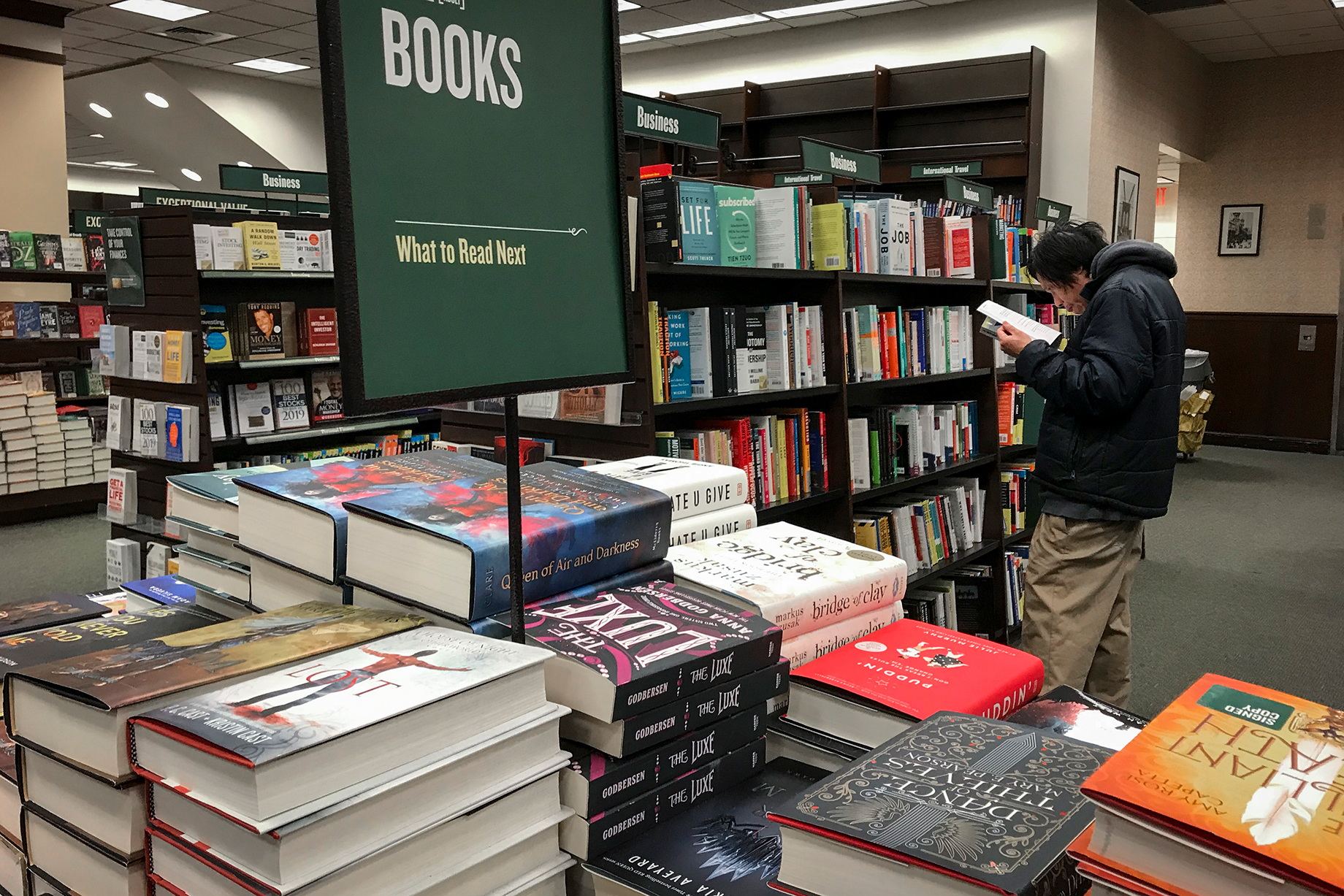

Barnes & Noble, the largest U.S. book retailer, will be acquired for $683 million by the same private-equity firm that owns the largest U.K. bookseller, Waterstones.

The buyer, a group of funds advised by Elliott Advisors Limited, paid cash and assumed the retailer's outstanding debts. Following the close of the transaction, Elliott Advisors will own both Barnes & Noble and Waterstones, and though each bookseller will operate independently, they will have a single CEO and share common best practices.

Elliott Advisors says it seeks to address the significant challenges facing the brick-and-mortar book retail space by applying to the Barnes & Noble's operations a model that has successfully turned Waterstones around over the past decade.

Barnes & Noble operates 627 bookstores across 50 U.S. states. Waterstones is the U.K.'s and Ireland’s leading high-street bookseller, with 293 bookshops — including the Foyles, Hatchards and Hodges Figgis banners — and a presence also in Brussels and in Amsterdam, the Netherlands.

By Brannon Boswell

Executive Editor, Commerce + Communities Today