Big banks are closing antiquated branches at a record pace, but they are also opening smaller and more-digitally-focused ones to better serve their customers, according to research from JLL’s Branch Banking 2020. After peaking at 100,000 branches in 2009, the number of bank branches has plunged by 13,200.

Five bank branch trends

-

Branch bank consolidation continues; 3,164 branches closed last year

-

The biggest institutions are closing the most branches; the 25 largest banks closed 1,777 branches

-

Even as branches close, deposits are growing; the amount of money deposited at branches grew 4.1 percent last year to $12.8 trillion.

-

Banks are still branching out; the 25 largest banks accounted for a fifth of the 1,481 branches added in 2019, and regional and community banks opened the rest

-

Branches are getting smaller; most new branches measure 2,000 to 3,500 square feet, significantly less than the 5,000-to-7,000-square-foot branches of the past

Regions Bank operates about 1,500 branches and 2,000 ATMs across the South, Midwest and Texas

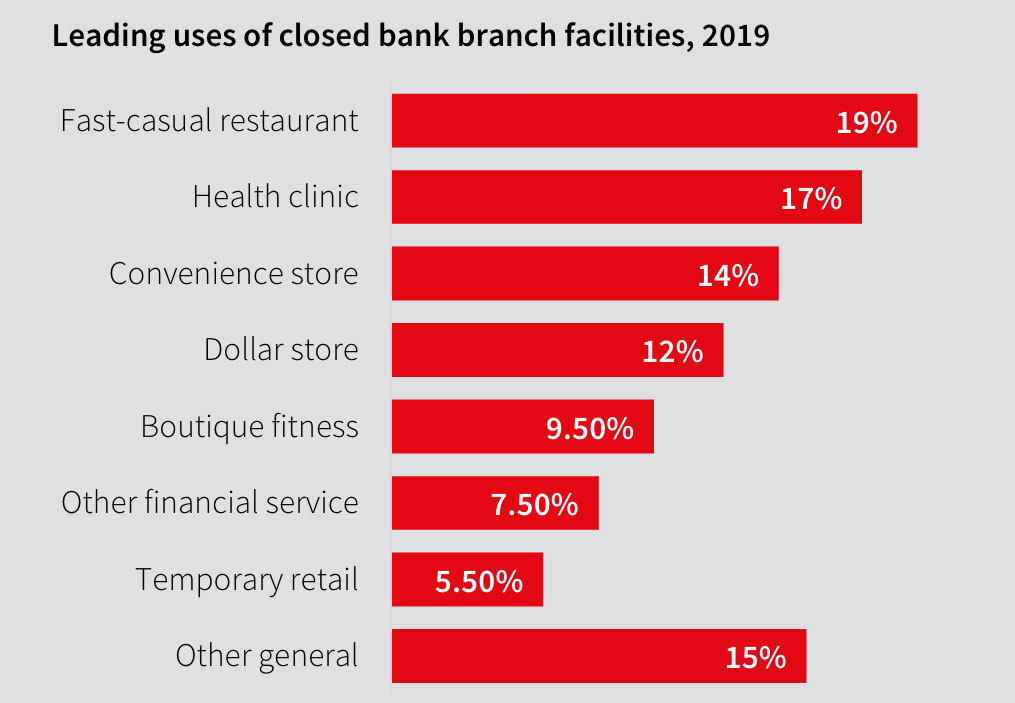

When a bank branch does close, landlords have plenty of options for refilling the space, JLL says. Competing banks and financial institutions often snap up well-located suburban facilities. And in-line spaces are often repurposed as restaurants, convenience stores and clinics. On average, the time period for selling a vacated branch is about nine and a half months, and the average time for subleasing is slightly over a year, according to JLL.

Source: JLL

By Brannon Boswell

Executive Editor, Commerce + Communities Today