After years of dormancy following the 2008 financial crisis and a pandemic thrown in for good measure, retail development has returned to the Phoenix metro in a big way. The metro had 2.2 million square feet of retail space under construction entering 2024 and an additional 3.6 million square feet proposed, according to Marcus & Millichap.

The key drivers are simple: robust population growth and a lack of new supply over the past 15 years. “The Valley continues to grow by 80,000 to 100,000 people per year, so you have a ton of pent-up demand for retail space and now developers are really scrambling to bring new product to market,” said James DeCremer, principal in Avison Young’s Phoenix office.

West Phoenix, the East Valley and North Phoenix ranked first, second and fourth in the U.S. for retail net absorption in 2023. Retailers continue to expand aggressively across the suburbs in response to Maricopa County’s nation-leading population growth. “We are back to pre-great-financial-crisis levels with retail operations and occupancy, and the rent growth is tremendous,” said Marcus & Millichap first vice president and regional manager Ryan Sarbinoff. “Phoenix is setting records in retail rental increases and occupancy again.”

Given retailer demand, most new developments are substantially pre-leased. As of October, more than 80% of the retail space that was underway in Phoenix was pre-leased, according to Marcus & Millichap. The increased demand has led tenants to pay a premium to secure high-quality retail space, according to DeCremer. Average market rents jumped from $21.90 per square foot in the third quarter of 2022 to $23.78 per square foot in the third quarter of 2023, an 8.6% year-over-year increase. And rents on new retail construction projects are in the $45- to $55-per-square-foot range, he said. “Rents on new construction are through the roof, which is driving up existing rents, and we’re not going to find equilibrium for a while.”

In fact, Phoenix leads the nation in annual retail rent growth according to Avison Young, far exceeding all other major cities. The second and third markets on the list are Atlanta, where rents have increased 6.3% and the Inland Empire, where they grew 4.6%.

MORE FROM C+CT: No Development, You Say? Plenty of Mixed-Use Is Moving Dirt in Atlanta

Despite the higher rents, Phoenix retail vacancy started the year at an all-time low of less than 5%, said DeCremer. Among the most active tenants are grocers, as well as those that were considered high risk during the pandemic: fitness centers and kids entertainment centers. These tenants, along with pickleball facilities, continue to fill remaining vacancies in shopping centers and mixed-use developments at rates higher than were seen pre-pandemic. “Now that COVID is in our rearview mirror, those users are having their comeback in full swing.”

MORE FROM C+CT: The Picklr Plans 500 Pickleball Locations

Phoenix recorded 373,525 square feet of positive net retail absorption in the third quarter, marking the 12th consecutive quarter of positive net absorption, according to Avison Young. However, absorption has slowed over the past several quarters due to supply-side pressure, leaving little space on the market and increased competition for space that is still available. “There are tons of tenants chasing a very limited amount of retail space,” said DeCremer. “I don’t see that letting up any time soon.”

9 Projects Going Up

One of the most active retail developers is Vestar, which acquires, manages and develops retail property in the western U.S. It owns and operates more than 30 million square feet and has 1.2 million square feet in development, including five major projects across Phoenix. “There has been no new retail development of any significance other than some pads built here or there and some small shop deals for almost 15 years, so you have had this pent-up demand for new retail,” said Vestar executive vice president of development Jeff Axtell.

The largest of Vestar’s developments is Verrado Marketplace in Buckeye, west of Phoenix, one of the metro’s fastest-growing suburbs. Similar to the developer’s 1.2-million-square-foot Desert Ridge Marketplace, which opened in 2001 in North Phoenix, Verrado Marketplace will cluster major anchor retailers like Target, HomeGoods, Marshalls and Ross Dress for Less with an adjacent area for a Safeway, specialty shops and restaurants. A plaza area will include a theater and additional food-and-beverage venues. “The Marketplace is our premium brand project,” said Axtell. “Tenants know that when they are going to a Vestar Marketplace project, they are getting a higher level of quality and a higher level of participation by Vestar in terms of the marketing and the events and the different ways to drive traffic and sales to the center.”

Construction on Vestar’s 500,000-square-foot Verrado Marketplace regional shopping center is scheduled to start in October and open in spring 2026.

Verrado Marketplace will include the first location of BackLot, a new concept from Scottsdale, Arizona-based Harkins Theatres. BackLot combines a movie theater with a family entertainment center in a movie-studio theme. “This is significant for the whole area because there is nowhere for these people to do family entertainment and movies within about a 10-mile radius,” said Axtell. “That is going to be a significant draw to the shopping center.”

In the northwestern suburb of Peoria, construction is underway on Vestar’s 90,000-square-foot Shops at Lake Pleasant at North Lake Pleasant Parkway and Happy Valley Road. It’s nearly 100% leased and scheduled to open by midyear. The tenant roster features specialty, service and dining tenants like Raising Cane’s, Over Easy, Handel’s ice cream, Visionworks and a neighborhood health facility. Vestar developed and owns the adjacent 650,000-square-foot Lake Pleasant Towne Center, where tenants include Sprouts, Kohl's, Ross, PetSmart, Michaels, The Home Depot, Harkins Theatres, OfficeMax, Ulta Beauty, Five Below and Bath & Body Works. The developer purchased the land for the Shops at Lake Pleasant from the state of Arizona. “This will really expand our existing center and help bring in additional restaurants and services to the community,” said Axtell.

In the fast-growing northwestern suburb of Surprise, Arizona, another large development, Village at Prasada, is nearing completion. The 700,000-square-foot power center from Scottsdale-based SimonCRE offers shops, restaurants and entertainment at the intersection of Waddell Road and Loop 303.

SimonCRE’s 700,000-square-foot Village at Prasada power center is nearing completion.

The 308,640 square feet in Phase 1 is fully leased to 31 tenants, including anchors Sprouts, Ross, HomeGoods, Marshalls, Ulta Beauty, Total Wine & More, PetSmart, T.J.Maxx and Floor & Decor. Other tenants already open include Black Rock Coffee Bar, Chick-fil-A, Fat Cats family entertainment center, The Habit Burger Grill and Panera. Tenants coming include Burlington, Cold Beers & Cheeseburgers, Dick’s Sporting Goods, Hobby Lobby, Kohl's, Lou Malnati's Pizzeria and O.H.S.O. Brewery & Distillery. In December, Barrio Queen, an elevated Mexican restaurant founded in Old Town Scottsdale in 2011, opened its eighth Valley location at Village at Prasada.

On the other side of Waddell Road, east of Sarival Avenue, SimonCRE expects to open the 350,000-square-foot Prasada North in late 2024, including tenants like American Furniture Warehouse, Boot Barn, Portillo’s and Target.

In the Southwest Valley, Vestar’s 400,000-square-foot Laveen Towne Center’s rustic architecture will complement Laveen Village’s agricultural atmosphere. Construction at Loop 202 and Dobbins Road is set to start in spring 2025 within a master-planned development with 50 acres of retail and 25 to 30 acres of residential. “We have designed the project around an old farmhouse and a hay barn, and we can put a really cool restaurant in there and hold events and different holiday gatherings in this town green village area,” said Axtell. Vestar plans to announce anchors this year. “The driver here is the growth of the residential and a big employment base,” said Axtell. “This is really the last large developable piece of land there, and the village of Laveen doesn’t really have a town square or gathering place. The goal with this is to create a critical mass of retail, restaurants and shops, along with a village green where we are restoring the farmhouse and the hay barn, to create for them kind of a town square.”

In suburban Queen Creek in Southeast Phoenix, Vestar has two major projects underway. Queen Creek Crossing is a 31-acre shopping destination at South Ellsworth Road and East Fulton Parkway. Construction on Phase 1 started in summer 2022, and the first tenant in Phase 2 opened this January. The project is 100% leased.

Costco opened at the 31-acre Queen Creek Crossing in January 2023. Ashley opened a 45,000-square-foot a year later, and a 55,000-square-foot Hobby Lobby is scheduled to open this month.

Also in Queen Creek, Vestar’s 23-acre Vineyard Towne Center will offer shops, services and restaurants over two phases. Sprouts Farmers Market opened in August, marking the Phase 1 grand opening. Phase 2 is scheduled to break ground later this year. Target will open in 2025.

Vineyard Towne Center’s Sprouts Farmers Market opened in August to a long line of customers.

And Barclay Group is developing the 198,000-square-foot Hudson Station at the southwest corner of Queen Creek Road and Signal Butte Road. Grocer Fry’s is scheduled to open a 122,000-square-foot store there this month. The center’s five-mile trade area boasts an average household income of more than $100,000 and a population of over 130,000. In addition, construction on more than 60,000 housing units will begin in the near future.

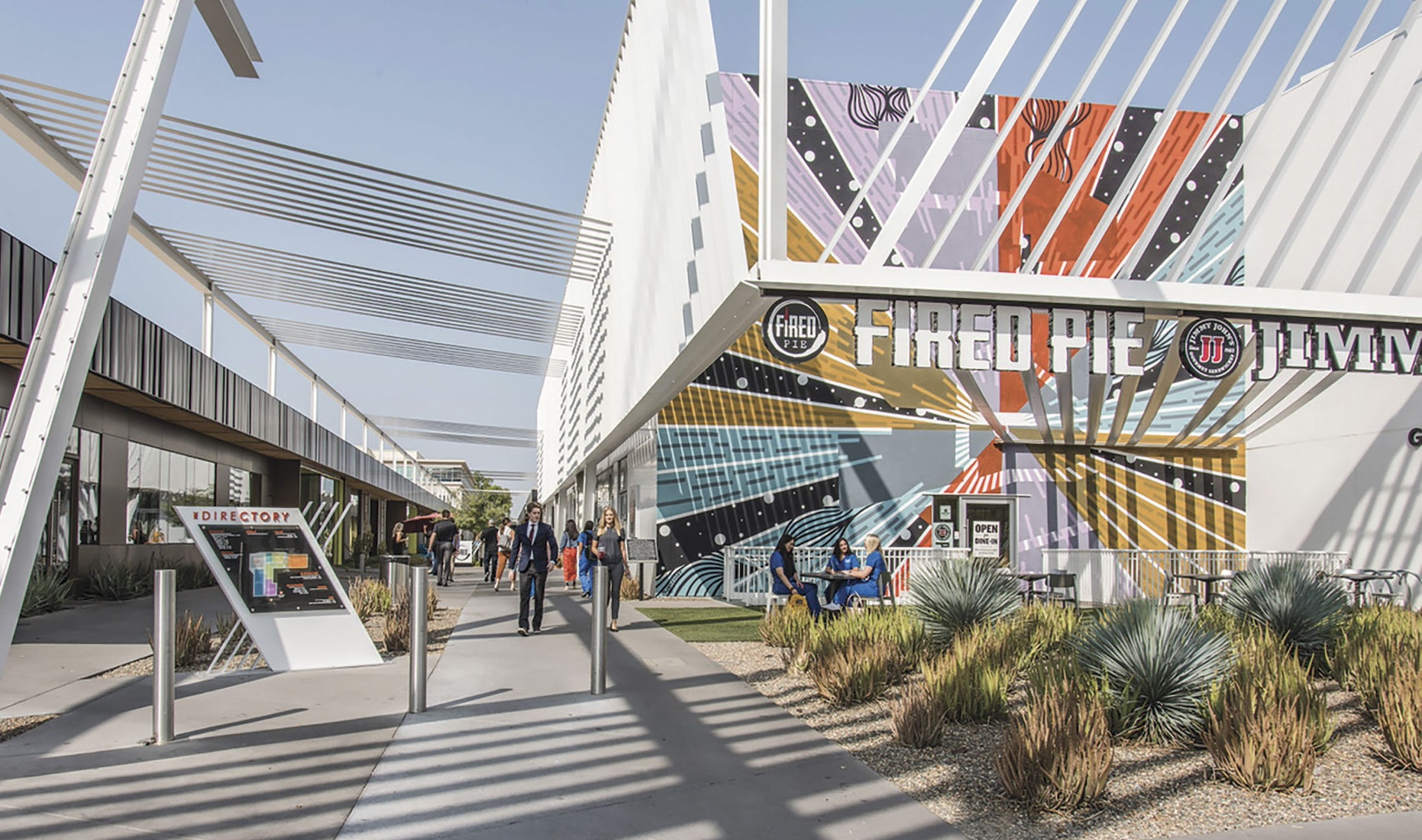

In Midtown, just north of downtown Phoenix, Plaza Cos. and Holualoa Co are redeveloping the city’s first large-scale shopping mall — Park Central Mall opened in 1957 — into the 500,000-square-foot Park Central community hub. Class A office there will offer 15- to 25-foot ceilings and tenant patios, complemented by on-site restaurants and amenities. A mid-century modern design, a bike path, light rail access and ample parking tie it together. “We are very proud of the momentum we are seeing at Park Central, as all of these different tenants and uses come to life,” said Plaza Cos. president and CEO Sharon Harper. “Park Central is really fueling a resurgence in Midtown Phoenix, and we are pleased with the impact the property is having on the central city.”

Plaza Cos. and Tucson’s Holualoa Cos. have teamed up to redevelop the city’s first large-scale shopping mall into Park Central, an office and retail community hub.

“Park Central is truly becoming an ideal location for living, working, playing, lodging and educating,” said Holualoa COO Stan Shafer. “All of these uses will feed into each other to make the experience at Park Central even better for residents, tenants, students and visitors. This is exactly the kind of growth and evolution we envisioned when the revitalization efforts began just six years ago.”

Developers and Retailers Think of Phoenix Differently Now

One indicator of the popularity of Phoenix-area retail developments was the $53.4 million permanent loan that commercial mortgage banking firm Gantry secured in mid-2023 to retire construction debt for the first phase of Village at Prasada. “Suburban retail centers have performed consistently in recent years, and our top correspondent lenders continue to compete for allocations to the sector,” said Gantry principal Tim Storey. “Retail — like multifamily, industrial and self-storage — continues to shine as an asset class worthy of the best rates currently available in today’s capital markets.”

It helps that developers in the Phoenix market learned much from the Great Recession. “Before 2008, there was such a run-up of supply and then a lot of bankruptcies happened. You had this big load of space for a long time, and that is no longer the condition,” said Axtell. “It is more favorable for us, and we actually have competition for the spaces now with two or three tenants for each space, whereas 10 years ago you would have had one tenant for three spaces.”

The lack of supply has pushed retailers to think of Phoenix differently, as well. “Retailers have come to the realization that if new centers are going to be built and they want to open up new stores, they are going to have to pay rents commensurate with construction costs,” said Axtell. “In the past 15 years, rents have only gone up, say, 30% to 50%, but construction costs have more than doubled. Phoenix is performing so well as a market and their existing stores are outperforming stores in other markets, so they can have a more reliable sales forecast for what a new store would do here. And then they can base their rent upon that.”

The cost of new construction certainly is helping to pump the brakes on overbuilding. Over the 12 months that ended in September 2023, construction costs in Phoenix grew by 4.9%, more than double the national increase of 2.3% according to the Mortenson Construction Cost Index. This has the potential to skim the pipeline down a bit as builders cancel, stall or downsize projects due to higher construction costs.

Despite the recent boom in new development, the pace of future construction is measured. According to Marcus & Millichap, just 600,000 square feet is underway for 2025 and beyond, a substantial drop-off from recent levels. Still, an additional 2.2 million square feet is proposed, and while construction will slow, completions are likely to remain around 1 million to 1.5 million square feet in 2025 and 2026.

Housing creation, a key driver of retail development in Phoenix, also is slowing somewhat. While almost 28,000 apartments are slated for delivery in 2024, the number lessens to a smaller but still above average 17,000 units in 2025, according to Marcus & Millichap. “While the exact number of units that ultimately open over the next two years may not match these estimates exactly, the downward development trend is clear,” said Sarbinoff.

Still, what else is clear is the attraction that the Phoenix area holds for those moving in. “There are all these great things going on and a lot of positive things happening here, and it is exciting and it is fun to be here,” said Axtell.

By Ben Johnson

Contributor, Commerce + Communities Today