U.S. Retail Properties’ Investment Value Approaches $3.8 Trillion

A new report assigns a multitrillion-dollar figure to the investment value of retail real estate in the U.S. The report from real estate investment manager Clarion Partners and real estate economics consulting firm Rosen Consulting Group estimates the investment value of U.S. retail properties at nearly $3.8 trillion. Of that sum, lifestyle centers, power centers and malls account for $583.2 billion. The category encompassing neighborhood, community and strip centers makes up $1.1 trillion. The most valuable category, “other retail,” adds up to $2.1 trillion. “Other retail” refers to properties like high street shops and single-tenant stores.

Overall, the investment value for U.S. commercial real estate amounts to $26.8 trillion, the report said. Multifamily accounts for $5.8 trillion, industrial for $3.29 trillion, office for $3.26 trillion and hospitality for $806 billion.

Blackstone Will Buy ROIC for $4 Billion

Asset manager Blackstone is scooping up Retail Opportunity Investments Corp., a REIT that owns 93 grocery-anchored retail centers on the West Coast, in an all-cash deal valued at roughly $4 billion. The transaction, announced on Nov. 6, represents a premium of 34% to ROIC’s stock closing price on July 29. ROIC’s portfolio comprises 10.5 million square feet of retail space concentrated in the Los Angeles, San Francisco, Seattle and Portland, Oregon, markets. The $17.50-per-share deal between the two publicly traded companies is expected to close in the first quarter of 2025. ROIC’s revenue for the first nine months of this year totaled $252.1 million, up from $243.1 million in the same period last year.

Among ROIC’s 93 properties is the seven-unit, 52,051-square-foot Trader Joe’s at the Knolls in Long Beach, California.

“This transaction reflects our strong conviction in necessity-based, grocery-anchored shopping centers in densely populated geographies,” said Jacob Werner, co-head of Americas acquisitions at Blackstone Real Estate. “The sector is experiencing accelerating fundamentals, benefiting from nearly a decade of virtually no new construction, while demand for brick-and-mortar grocery stores, restaurants, fitness and other lifestyle retailers remains healthy.”

Blackstone also will gain the 36-unit, 116,403-square-foot Bressi Ranch Village Center in Carlsbad, California.

Residential Makes Up a Quarter of Simon’s $4 Billion Pipeline

Simon’s development and redevelopment pipeline is bursting. During the retail REIT’s third-quarter earnings call on Nov. 1, chair, president and CEO David Simon said the REIT’s pipeline is around $4 billion. “We’re going full steam ahead,” Simon told analysts. Included in the pipeline are “massive mixed-use opportunities” like Barton Creek Square mall in Austin, Texas, and Fashion Valley mall in San Diego, he said.

Of the roughly $4 billion pipeline, more than $1 billion is earmarked for residential projects. Among those is an 850-unit apartment complex at Fashion Valley that Simon is building in partnership with AMLI Residential.

Simon has earmarked more than $1 billion of its $4 billion development pipeline for residential, including an 850-unit apartment complex that it and AMLI Residential are building at Simon's Fashion Valley mall in San Diego.

Kimco Says Demand Is “Pouring In”

Kimco Realty, a REIT that owns and operates grocery-anchored suburban retail centers, is seeing “broad-based and diverse” demand for retail space as leasing activity takes off. During the company’s recent earnings call, CEO Conor Flynn said tenants in the beauty, health-and-wellness, fitness, medical, service and off-price grocery segments continue to vie for space at Kimco properties. In the third quarter, Kimco matched the record-high occupancy rate of 96.4% that it set in the fourth quarter of 2019. The REIT tallied 119 leasing deals totaling 543,000 square feet in the third quarter of 2024.

“The consumer continues to be resilient,” Flynn told analysts. “The retailers continue to want to expand in shopping centers of high quality with really strong operators, and we continue to see the outreach pouring in for spaces that we have available.”

Kimco Realty announced on Oct. 1 that it had acquired the 976,000-square-foot Waterford Lakes Town Center in Orlando for $322 million, including the assumption of a $164 million mortgage. The property was built in 1999. According to Kimco, opportunity exists in the fact that several original tenants’ leases will expire soon, as demand grows from high-end tenants that can pay higher rents.

Google Debuts Its First Shopping Center Store

Google’s first mall store opened Nov. 1 at Oakbrook Center in suburban Chicago. The 2,000-square-foot store in Oak Brook, Illinois, sells Google products like Fitbits, Nests and Pixels, along with branded merchandise. This location joins two Google stores in New York City, one in Boston and one at Google’s Mountain View, California, headquarters.

“We are planning to open more stores around the country,” Google spokesperson Liz Bagot told the Chicago Business Journal. “We’re continually exploring different ways to reach our customers, which is why we chose to open a store in a shopping center outside of a major city. And we’ll continue to open stores in a variety of locations, always taking customer feedback into account.”

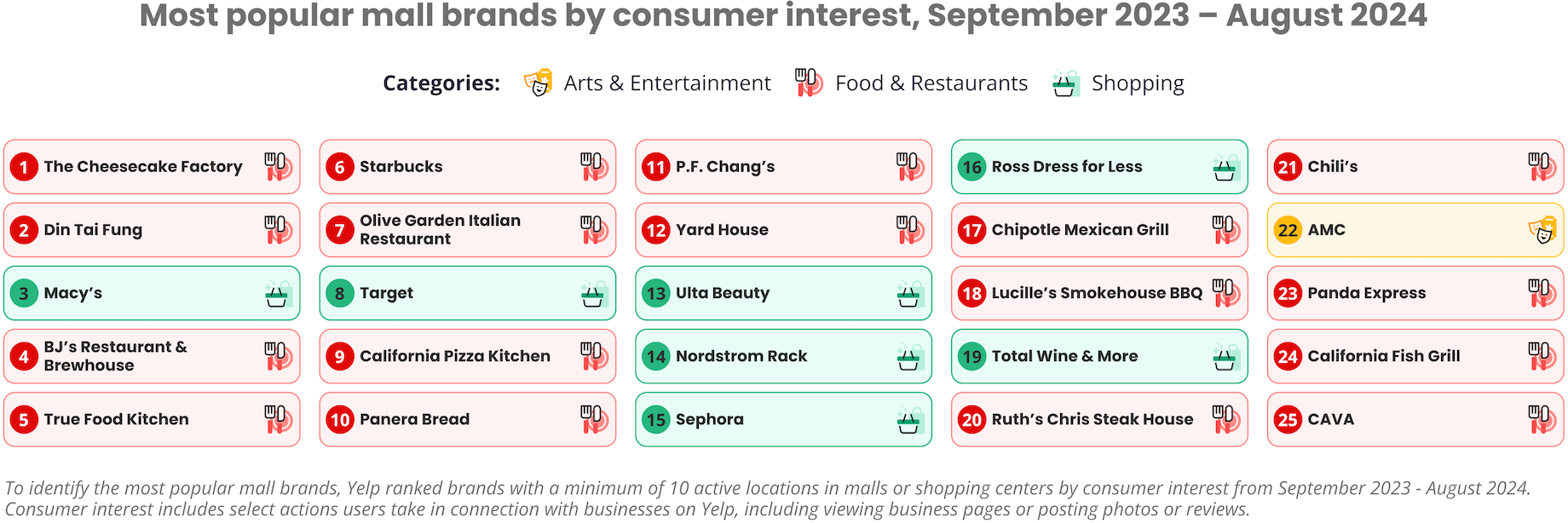

Dining Dominates Consumers’ Desire to Visit Malls

Consumers are eating up the restaurant scene at U.S. malls. Data from Yelp shows that over the past five years, people increasingly have been visiting malls for the restaurants. In fact, 17 of the 25 most popular mall brands from September 2023 to August 2024 were quick-service or casual dining restaurants, according to Yelp.

Source: Yelp Chart: The DataFace

High-end restaurants are interested, too. At CBL’s Fayette Mall in Lexington, Kentucky, Mileta will open on Saturday. It marks a return to the mall for owner Dallas Rose, who grew up spending time there with family and friends.

High-end restaurant Mileta will open Saturday at Lexington, Kentucky’s Fayette Mall, offering handmade pasta, a raw bar, charcuterie and seasonal cooking in a setting inspired by both midcentury modern and bohemian aesthetics.

“The rise of restaurants and dining experiences as the primary reason for mall visits represents a significant shift in consumer behavior,” Yelp noted. “While traditional retail remains important, the focus has shifted towards food and entertainment, with restaurants playing a central role in attracting visitors.”

TGI Fridays Operator Files for Chapter 11 Bankruptcy Protection

The owner and operator of 39 TGI Fridays casual dining restaurants in the U.S. voluntarily filed for Chapter 11 bankruptcy protection on Nov. 2. All 39 of the restaurants, controlled by TGI Fridays Inc., will remain open. Locations in 41 countries that are franchised through TGI Fridays Franchisor LLC are not part of the bankruptcy case. Chapter 11 bankruptcy will allow TGI Fridays Inc. “to explore strategic alternatives in order to ensure the long-term viability of the brand,” TGI Fridays Inc. said.

Executive chair Rohit Manocha said the company’s financial challenges arose from COVID restrictions and its capital structure. The company’s assets and liabilities range from $100 million to $500 million each, according to USA Today. Including company-owned and franchisee-owned locations, more than 460 TGI Fridays restaurants operate around the world.

By John Egan

Contributor, Commerce + Communities Today