4 retailers expanding to new U.S. markets

Sporting goods chain JD Sports opened its first store in Pennsylvania, at Lancaster’s Park City Center. The U.K.-based retailer has more than 770 stores, including more than 50 in the U.S. Jeni’s Splendid Ice Creams also will open its first Pennsylvania stores this year, in Philadelphia’s Fishtown and Rittenhouse Square. The company operates approximately 50 stores. Meanwhile, women’s underwear brand Spanx launched the company’s first store in Wisconsin, at the Milwaukee Mitchell International Airport’s revamped retail center. And Duck Donuts is opening its first unit in Idaho, a 1,500-square-foot restaurant at The Village at Meridian. The company operates 100 franchises in 27 states.

Another dot-com going for bricks-and-mortar

Zappos.com is testing out a store called Zappos Unboxed at Mall St. Matthews in Louisville, Kentucky. The 18,000-square-foot space will offer reduced-price apparel, some of it returns from online purchases. “Our customers can expect dynamic merchandising and product drops by some of their favorite brands, all at a great price,” said senior director of operations Sarah Fee. Zappos is a subsidiary of Amazon.

Speaking of Amazon

Amazon will add its palm-scanning payment system to the Whole Foods in Seattle’s Capitol Hill, not far from the company’s headquarters. In the coming months, it will roll out at seven other Seattle-area Whole Foods.

New quick-service food coming to Walmart

Walmart is adding new fast-food options to its stores as some longtime operators move out in search of drive-thru windows. McDonald’s expects to close roughly 325 stores in 2021, most of them inside Walmart. Decreasing traffic and profits are driving Subway franchisees out of Walmarts, too. Walmart is replacing them with the likes of Charleys Philly Steaks, Domino’s, Taco Bell and Ghost Kitchen Brands, a company that lets customers choose from a selection of concepts like Cinnabon, Jamba, Nathan’s Famous and Quiznos. Walmart also is testing French bakery and cafe La Madeleine in 10 Dallas-Fort Worth-area stores starting in July.

Speaking of Walmart

Walmart will phase out the 17-foot-tall, automated pickup towers the retailer had added to 1,500 stores to distribute online purchases. Customers have become accustomed to curbside pickup. “The customer told us they want one pickup spot, and they want that pickup spot to be outside,” a spokesperson said.

Drive-thru windows have become table stakes for this quick-service restaurant

Cousins Subs says drive-thru windows are driving sales. At the 35 of its stores that have drive-thru windows, sales grew 15 percent in 2020. The company is buying back its franchises and rebranding for a 20 percent annual expansion of corporate-owned stores over the next three years. It’s making a concerted effort to find new locations in endcaps or with drive-thru windows, says president Jason Westhoff. “We won't do anything without a drive-thru anymore unless there’s a real good reason to do it.”

RELATED: What it takes to add drive-thrus

Some things, you just have to try on

The pandemic hasn’t scared Americans away from shoe shopping in physical stores. Fifty-nine percent of consumers will shop predominantly in stores for footwear post-pandemic, according to research firm AlixPartners’ survey of more than 1,000 U.S. adult consumers. Since the start of the pandemic, 40 percent have shopped for shoes at specialty footwear stores, 33 percent at department stores and 16 percent at outlets or discounters.

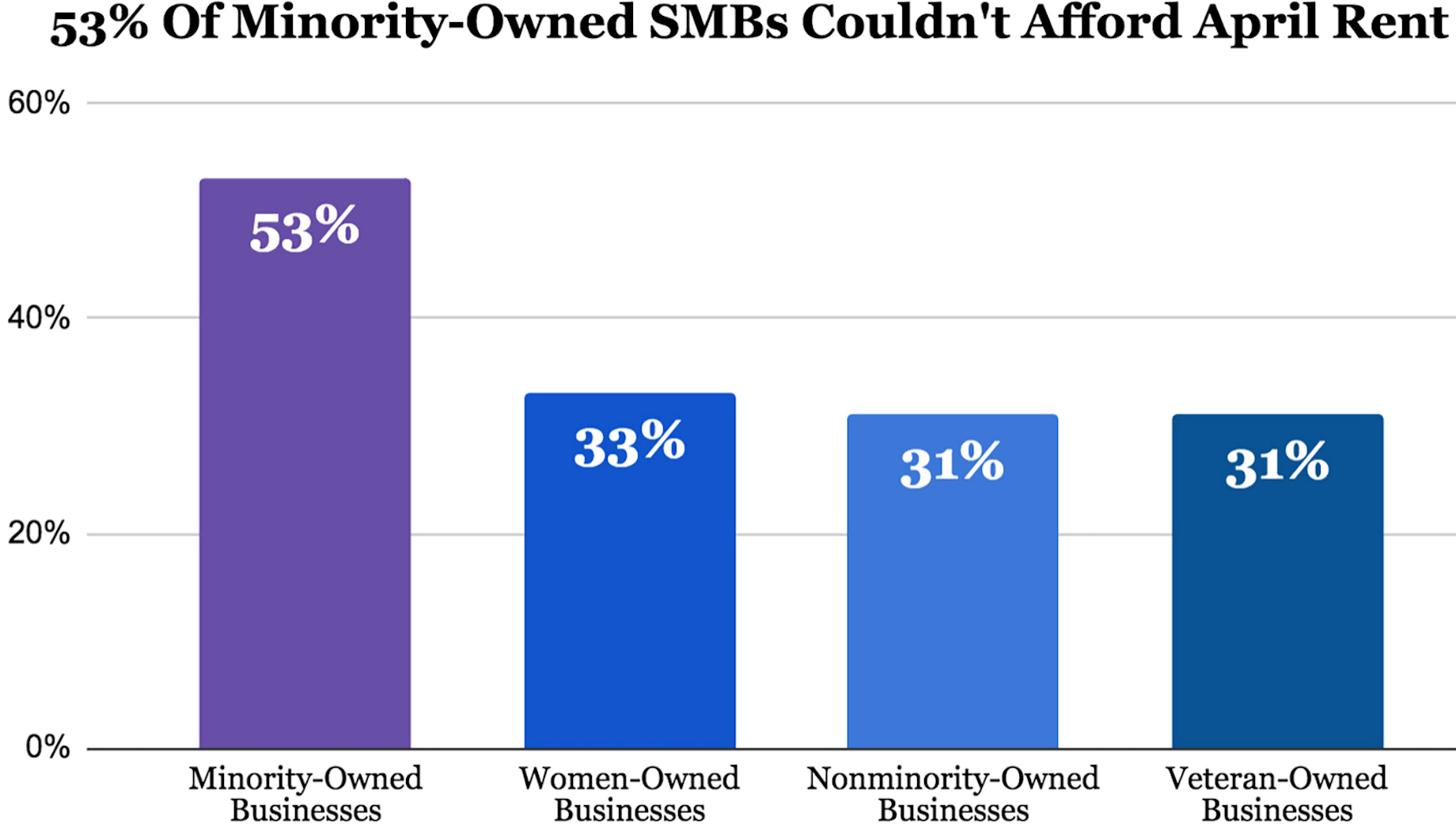

More than half of minority-owned businesses are still struggling to pay rent

Fifty-three percent of minority-owned small businesses could not afford to pay their full April rent on time, according to consulting firm Alignable’s April Rent Poll, a survey of 8,943 small businesses conducted March 27 to April 5. The survey showed that covering the rent remains a major obstacle for nearly one-third of all small business owners in the U.S.

Data-driven approach to restaurant air safety

Upscale restaurant Sierra Mar in California’s Big Sur is taking a data-driven approach to ventilation and air filtration, reporting real-time air-quality readings to potential customers. A $30,000 grant from the Community Foundation for Monterey County has funded an experimental system for Sierra Mar, designed at the University of Colorado, that includes 18 table-top mini-purifiers; 10 precisely distributed high-efficiency particulate air, or HEPA, purifiers; an HVAC system upgraded to MERV 13-level filtration; room dividers; and four air-quality sensors.

Guess what kind of retailer anchors the portfolio that just sold for $295 million

Winstanley Enterprises and Surrey Equities sold a 748,141-square-foot portfolio of 11 single-tenant retail buildings in Connecticut, Massachusetts and Rhode Island that are net leased to Stop & Shop. The Inland Real Estate Group of Cos. bought the portfolio for $295 million. JLL Capital Markets marketed the portfolio on behalf of the seller and secured two separate, 10-year, fixed-rate loans with a life company and with a commercial mortgage-backed securities lender for the buyer.

“This portfolio’s established and necessity-based footprint, combined with 20-year leases at all 11 properties in strong market locations, is an ideal example of the opportunities we seek to acquire as we move further into 2021,” said Inland Real Estate Acquisitions senior vice president Matthew Tice, who facilitated the acquisition on behalf of The Inland Real Estate Group of Cos.

High demand for single-tenant net lease properties helped drive up the price, JLL Capital Markets managing director Nat Heald said. “Since the value of these types of assets appreciated throughout the pandemic, we anticipate investors will continue to aggressively pursue these defensive positions within the retail sector and that demand will far outstrip supply for the foreseeable future.”

5 more recent retail property deals

A retail property at 604 Fifth Ave., in the heart of Manhattan’s Rockefeller Center traded for $45 million, approximately $2,500 per square foot. The seller was Riese Organization, which was once Manhattan’s biggest restaurant operator. The building, designed by Chrysler Building architect William Van Alen in 1925, was home to a TGI Fridays for 20 years. The buyer, Kemmei Okada, is president of Japanese confectioner Minamoto Kitchoan. “Fifth Avenue is having a bad PR moment,” said Compass vice chair Adelaide Polsinelli, who helped broker the deal with Adirondack Capital Partners president Michael Coghill. “This sale is the boost the corridor needed to remind retailers that this is a once-in-a-cycle opportunity to stake a claim in what is arguably the best address in New York City.”

RVI sold the 182,334-square-foot Uptown Solon in Solon, Ohio, to United Growth for $10.1 million. It’s anchored by Bed Bath & Beyond, Old Navy, Petco, Ulta Beauty and Lumber Liquidators.

PDQ Israel Family Countryside sold the 198,000-square-foot Countryside Plaza, in East Huntingdon Township, outside Pittsburgh, to Mt. Pleasant Realty Associates for $8.5 million. The center, whose supermarket anchor closed in 2019, is being converted to accommodate a Busy Beaver home improvement store. The project is scheduled for completion by October.

Pinnacle Leasing & Management purchased the 70,000-square-foot Sugarcreek Plaza in Dayton, Ohio, from Pebb Enterprises for $7.45 million. Tenants include Affordable Uniforms, Bed Bath & Beyond, Buy Buy Baby and Planet Fitness.

A portfolio of two Food Lion-anchored shopping centers in North Carolina traded for $5 million: the 65,728-square-foot Montgomery Square in Troy and the 36,031 Fork Road Shopping Center in Norwood. Cleeman Realty Group represented the seller, and Premier Real Estate represented the buyer in the off-market transaction.

This time last year …

Here’s what the industry was talking about in the midst of the pandemic a year ago this week:

7 ways landlords are helping small business tenants

Kite will lend directly to its small business tenants

Texas shopping centers embrace retail-to-go

Net lease REITs Agree and Spirit say most tenants paid April rent

How COVID-19 has changed the state of cannabis real estate

How to access government cash

Which tech tools are best for remote work?

Next steps for job seekers

10 developments to pay attention to

Argent Ventures and H&R REIT announced plans to build The Cove JC — a mixed-use hub for life sciences, tech and medicine businesses — on a Jersey City, New Jersey, brownfield. The 13-acre campus, pictured at top, will comprise 1.4 million square feet of lab/tech office and 1.6 million square feet of residences. Groundbreaking is slated for 2022. The first phase encompasses two academic/laboratory/teaching facilities and a commercial life sciences building totaling as much as 833,899 square feet. The commercial building will include street-level retail. The plan also calls for a 3.5-acre waterfront park linked to the Hudson River Waterfront Walkway. The second phase calls for two commercial laboratory/office buildings totaling 596,000 square-feet.

In Buffalo, New York, the owners of home decor retailer Michael P. Design and upscale barber shop Crockett & Co. purchased a former synagogue and plan to convert the property into a multitenant retail center called The Monocle to be anchored by their stores. Grand opening is set for November.

Developer Mill Creek Residential broke ground on Modera Six Pines, five-story mixed-use apartment community in The Woodlands, Texas, the master-planned community north of Houston. Next to the residences, Life Time is building a 175,000-square-foot gym with a health-and-wellness theme aimed at renters craving outdoor activities. Grand opening is slated for spring 2022.

The Publix-anchored Nine Mile Crossing opens in Pensacola, Florida, next week. Construction began on the 48,387-square-foot Publix in January 2020. Nine tenants, including a national pizza restaurant, a national hair salon chain, a nail salon and a medical tenant have signed on to occupy the center’s 18,000 square feet of small shop space.

Barber Cos. is converting the vacant former Trussville Bowling Lanes building in downtown Trussville, Alabama, into an 8,700-square-foot multitenant retail center, part of a larger effort to make the downtown more pedestrian- and retail-friendly.

The Charlotte, North Carolina, city council approved Northwood Investors’ plan to add 330 multifamily units in a 20-story tower at the mixed-use Metropolitan. The company also is refreshing the center’s retail, which is anchored by Best Buy, Marshalls and Trader Joe’s.

Developer Terra Perpetua and municipal officials are moving forward with Bel Air Village, a master-planned community in Sherman, Texas, that will include 1,000 homes, several thousand apartments, retail and restaurants all built around a lagoon-style swimming pool open to the public. Phase I could open as soon as this summer.

Architecture firm Cicada and Perrier Esquerre Contractors are overseeing the redevelopment of an historic, 11,600-square-foot former theater in New Orleans’ Uptown into a mixed-use property with ground-floor commercial space for food-and-beverage, fitness and retail concepts below four apartments. Completion is scheduled for this summer.

Baker Storey McDonald Properties broke ground on the first phase of Marketplace at Savannah Ridge, a 24-acre, retail development in Murfreesboro, Tennessee. The Aldi anchor will open in November, along with two 6,000-square-foot retail buildings. Future phases will include four out-lots and a mixed-use component.

Mast Landing Brewing Co. will open in a new 11,000-square-foot space at WS Development’s Freeport Crossing in Freeport, Maine, this summer. Mast Landing’s space will span two floors and include a tasting room, as well as a brewing facility to produce small batch beers exclusively for the new location and to test ideas that could develop into wider production. The second floor will convert to a 4,000-square-foot private event space.

Résumé updates

New Seritage Growth Properties president and CEO Andrea Olshan is changing up the C-suite, promoting Mary Rottler to COO, Andrew Galvin to chief investment officer and Eric Dinenberg to executive vice president of development. Matthew Fernand will become chief legal officer.

Rottler previously has been executive vice president of leasing and operations since the company’s inception in 2015. She will manage leasing, operations, tenant coordination and retail development. Prior to joining Seritage, she served as vice president of real estate for Wal-Mart Stores.

Galvin was executive vice president of investments. He will oversee transactions, asset management and capital allocation. Prior to joining Seritage, he served as executive vice president and chief investment officer for Centennial and held investment positions at Trademark Property Co., Rouse Properties and General Growth Properties.

Dinenberg previously served as senior vice president of development. He will head development and construction. Prior to joining Seritage, he served as executive vice president of development and operations for Brookfield Properties. He also worked in development at Rouse Properties and Vornado Realty Trust.

Fernand previously was general counsel and executive vice president. Prior to joining Seritage, he was a partner in Sidley Austin’s real estate group.

Kenneth Lombard, previously executive vice president and COO, will become a special advisor, and executive vice president of development and construction James Bry will leave the company.

Send news to executive editor Brannon Boswell.

By Brannon Boswell

Executive Editor, Commerce + Communities Today